P Bridge Biotherapeutics Drops on Trial Miss; Deepnoid Rallies[K-bio Pulse]

created on 04/16/2025 7:30:33 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 04/16/2025 7:30:33 AM

Subscribe

[Kim Jin-soo Edaliy Reporter] Shares of Bridge Biotherapeutics nosedived Monday after the biotech firm failed to demonstrate efficacy in a key clinical trial for its idiopathic pulmonary fibrosis (IPF) drug candidate. Meanwhile, AI healthcare company Deepnoid rallied on renewed attention as a presidential election-themed stock and promises of large-scale investments in artificial intelligence. YuYu Pharma also drew investor interest following aggressive shareholder-friendly moves.

Bridge Biotherapeutics Slumps After Phase 2 Miss

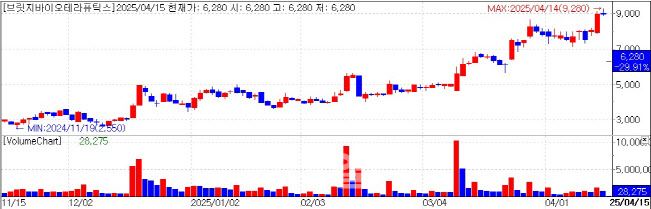

Bridge Biotherapeutics’ stock opened at its daily lower limit, sliding 29.91% to close at 6,280 won, according to MP Doctor, formerly Market Point. The stock had surged 118% since Feb. 6, hitting a 52-week high of 8,960 won as of April 14.

The selloff came after the company reported that BBT-877, its lead IPF treatment candidate, failed to meet the primary endpoint in a Phase 2 trial. The top-line data, released April 14, showed a decline in forced vital capacity (FVC) over 24 weeks of -75.7 mL in the treatment arm, versus -50.2 mL in the placebo group. The p-value was 0.385, indicating no statistically significant difference.

Bridge had pinned its financial hopes on licensing out BBT-877 post-trial. The firm even accepted the risk of being flagged as an “under watch” stock by regulators due to unmet operating income criteria. With efficacy unproven, concerns over a potential delisting have surfaced.

The company said it would further analyze the trial results and consider repurposing the drug for other indications, given no major safety concerns. As BBT-877 is an autotaxin inhibitor, it may be explored for relapsed metastatic ovarian cancer or aortic valve stenosis. Pipeline reprioritization, potentially elevating programs like BBT-207 and BBT-301, is also on the table.

Bridge Biotherapeutics said it currently holds about 20 billion won in cash, enough to continue the detailed analysis of BBT-877 or pursue further trials for BBT-207.

Deepnoid Soars on Election Buzz and AI Promises

Deepnoid shares jumped 18.71% to close at 7,360 won. The medical AI firm has recently been spotlighted as an election-themed stock tied to former Democratic Party leader Lee Jae-myung.

The company is developing M4CXR, an AI-powered solution for automated chest X-ray reports. Market interest intensified after the appointment of Dr. Hong Seung-kwon?an external director with ties to Lee’s healthcare policy advisory team.

Momentum further grew after both Lee and fellow presidential hopeful Han Dong-hoon pledged massive investments in AI. Lee proposed a 100 trillion won investment and the creation of a National AI Committee and data clusters. Han followed with a 200 trillion won investment pledge aimed at making South Korea one of the world’s top three AI powers.

A Deepnoid spokesperson said the stock‘s surge was driven largely by overlapping election and AI narratives, and not due to any specific internal developments.

YuYu Pharma Climbs on Shareholder-Friendly Moves

YuYu Pharma shares rose 2.09% to 4,640 won, while its preferred shares climbed 9.80% and 25% to 5,380 won and 12,300 won, respectively.

The rally followed a string of shareholder-focused actions. On April 15, the company announced it would exercise a call option to buy back and retire approximately 7.4 billion won worth of convertible bonds out of a 24.5 billion won issuance from 2023. This allowed the company to use zero-interest funds for two years while eliminating potential share dilution.

YuYu Pharma also began a 2 billion won share repurchase program targeting 471,142 common shares. Once complete, the company will hold 7.8% of its common shares as treasury stock.

“Strong 2023 earnings, aggressive buybacks, CB retirement, and expansion into the pet care market have combined to attract investor attention,” a company spokesperson said.

|

Bridge Biotherapeutics’ stock opened at its daily lower limit, sliding 29.91% to close at 6,280 won, according to MP Doctor, formerly Market Point. The stock had surged 118% since Feb. 6, hitting a 52-week high of 8,960 won as of April 14.

The selloff came after the company reported that BBT-877, its lead IPF treatment candidate, failed to meet the primary endpoint in a Phase 2 trial. The top-line data, released April 14, showed a decline in forced vital capacity (FVC) over 24 weeks of -75.7 mL in the treatment arm, versus -50.2 mL in the placebo group. The p-value was 0.385, indicating no statistically significant difference.

Bridge had pinned its financial hopes on licensing out BBT-877 post-trial. The firm even accepted the risk of being flagged as an “under watch” stock by regulators due to unmet operating income criteria. With efficacy unproven, concerns over a potential delisting have surfaced.

The company said it would further analyze the trial results and consider repurposing the drug for other indications, given no major safety concerns. As BBT-877 is an autotaxin inhibitor, it may be explored for relapsed metastatic ovarian cancer or aortic valve stenosis. Pipeline reprioritization, potentially elevating programs like BBT-207 and BBT-301, is also on the table.

Bridge Biotherapeutics said it currently holds about 20 billion won in cash, enough to continue the detailed analysis of BBT-877 or pursue further trials for BBT-207.

Deepnoid Soars on Election Buzz and AI Promises

Deepnoid shares jumped 18.71% to close at 7,360 won. The medical AI firm has recently been spotlighted as an election-themed stock tied to former Democratic Party leader Lee Jae-myung.

The company is developing M4CXR, an AI-powered solution for automated chest X-ray reports. Market interest intensified after the appointment of Dr. Hong Seung-kwon?an external director with ties to Lee’s healthcare policy advisory team.

Momentum further grew after both Lee and fellow presidential hopeful Han Dong-hoon pledged massive investments in AI. Lee proposed a 100 trillion won investment and the creation of a National AI Committee and data clusters. Han followed with a 200 trillion won investment pledge aimed at making South Korea one of the world’s top three AI powers.

A Deepnoid spokesperson said the stock‘s surge was driven largely by overlapping election and AI narratives, and not due to any specific internal developments.

YuYu Pharma Climbs on Shareholder-Friendly Moves

YuYu Pharma shares rose 2.09% to 4,640 won, while its preferred shares climbed 9.80% and 25% to 5,380 won and 12,300 won, respectively.

The rally followed a string of shareholder-focused actions. On April 15, the company announced it would exercise a call option to buy back and retire approximately 7.4 billion won worth of convertible bonds out of a 24.5 billion won issuance from 2023. This allowed the company to use zero-interest funds for two years while eliminating potential share dilution.

YuYu Pharma also began a 2 billion won share repurchase program targeting 471,142 common shares. Once complete, the company will hold 7.8% of its common shares as treasury stock.

“Strong 2023 earnings, aggressive buybacks, CB retirement, and expansion into the pet care market have combined to attract investor attention,” a company spokesperson said.

김진수 kim89@

![2% Royalty Shock at Alteogen Ripples Through Korean Biotech[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012200181b.jpg)

!['2% 로열티'가 무너뜨린 신뢰…알테오젠發 바이오株 동반 하락[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012201091b.jpg)