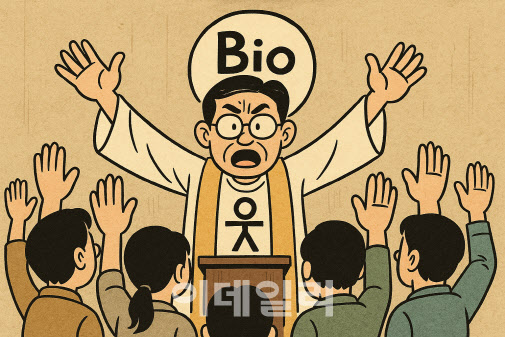

[Yoo Sung’s Pharma National Wealth Theory] K-Bio’s Cult Leaders and Blind Believers

created on 04/10/2025 8:14:48 AM

- Countless bio firms have failed to develop even a single viable drug in decades

Investors clinging to false hopes become blind followers

Founders mislead with grandiose visions, resembling cult leaders

More like pseudo-religions than biotech ventures

Only quick exits can prevent major losses

|

As irrational as it sounds, this is exactly what’s happening across South Korea’s biotech venture scene. The K-Bio landscape is still rife with companies that have never developed a single drug or successfully licensed out a technology in decades. Even more baffling is the loyal cohort of retail investors who never question these firms and continue to invest in them with unwavering faith.

These companies, which undermine trust in the broader K-Bio industry, still manage to position themselves as promising drug developers. Despite negligible revenues from actual drug development and their supposed core business, they excel at raising funds through rights offerings and convertible bonds. Their behavior is more akin to a financial firm than a biotech startup.

|

Many such companies announce plans to develop every high-profile drug, from COVID-19 vaccines to miracle treatments. But drug development is never their true goal, it’s a ruse to boost stock prices and secure funding. These pseudo-biotech ventures survive like parasitic fungi in the K-Bio ecosystem, enabled by the industry’s opaque development timelines.

Because drug development typically spans around 10 years, these companies have ample cover to dress up their deception. Only seasoned investors can see through the charade. Once public attention fades, the promised drugs quietly disappear, repeating a cycle that leaves the company older, but still without a single meaningful product. In truth, they never intended to develop a drug. Their real aim was to siphon off investment.

When Biotech Feels Like a Cult

Investors who devote themselves to these companies often resemble followers of a cult, incapable of rational judgment. When founders boldly claim they’re on the verge of success in new drug development or global tech transfers, these investors believe every word. For them, the CEO becomes a kind of guru, and no statement no matter how absurd is questioned.

Over time, the relationship between investor and company becomes almost religious. Long-term commitment hardens into emotional attachment, then evolves into blind faith. Even when presented with irrefutable evidence that the company is fraudulent or failing, these investors rarely waver. Worse still, they often lash out at critics and staunchly defend the firm.

But in investing, selective belief leads to certain losses. Ignoring red flags and clinging to fantasies is a recipe for failure. Any company that claims to be in drug development for decades without producing a single viable drug is the very definition of a counterfeit biotech venture.

Investors who treat such companies as sacred institutions must wake up. These pseudo-biotech firms are all heading for bankruptcy, only the arrival time differs. Even if you became a long-term investor against your better judgment, it’s never too late to get out. The only way to minimize your losses is to jump ship before it sinks.

류성 star@

![3billion, Prestige BioPharma Jump on Tariff Optimism[K-bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/04/PS25041100239b.jpg)

!['유예'에 투심 반짝…쓰리빌리언, 프레스티지 10%↑[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/04/PS25041100237b.jpg)

![모발 가늘어지고 가르마 넓어진다면 ‘이 영양제’[약통팔달]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/04/PS25041400006b.jpg)