Seers Technology Rally Continues; Overseas Momentum Still in Play[K-Bio Pulse]

created on 09/02/2025 7:05:13 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 09/02/2025 7:05:13 AM

Subscribe

[Lim Jeong-yeo, Edaily Reporter] On September 1, South Korea’s biopharma market saw gains led by Seers Technology, Helixmith, and Hugel. Seers Technology has been riding strong sentiment since becoming the first domestic medical AI company to post an operating profit. Helixmith drew attention on expectations for drug approval in China. Hugel rose on the back of foreign buying.

Seers Technology: First Profitable Medical AI Firm

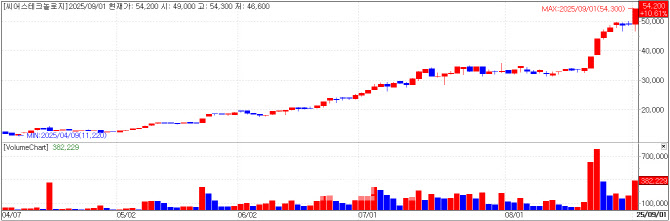

Shares of Seers Technology closed at 54,200 won on Monday, up 10.61% (5,200 won) from the previous session, according to KG Zeroin MP Doctor. The company’s market capitalization surged to 686.5 billion won -- triple the level at its IPO a year ago.

Seers Technology offers real-time monitoring of inpatients’ biosignals through wearable ECG patches, with AI-powered predictive analysis to detect early warning signs. Its reimbursement-based revenue-sharing model with hospitals has been cited as a strength in monetization.

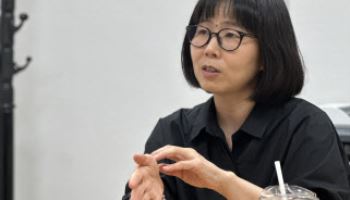

CEO Lee Young-shin told PharmEdaily that while multiple factors likely influenced the day’s rally, “expectations for second-half and next year’s earnings appear to be reflected,” adding that “overseas business momentum remains, and investors are looking ahead to details yet to be disclosed.”

Separately, Winvest Venture Partners, an early investor, sold 208,496 shares on the open market between July 11 and August 28 at 17,000 won apiece, raising about 3.5 billion won. Its stake in Seers Technology has since dropped from 7.81% to 6.11%.

Helixmith: Long-Dormant Pipeline Sparks Investor Interest

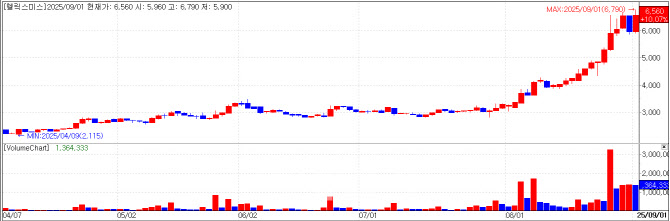

Helixmith shares climbed 10.07% to close at 6,560 won on Monday, doubling its market cap to 302.4 billion won in just a month. The company has been restructuring since Biosolution became its largest shareholder in December 2023, bringing in a new management team.

A major catalyst is the progress of VM202 (Engensis), licensed to Beijing Northland Biotech back in July 2004. Nearly two decades later, the gene therapy candidate, developed as “NL003” in China, has completed Phase 3 trials for critical limb ischemia and is awaiting regulatory approval.

While contract details are undisclosed, Northland secured rights limited to lower-extremity artery disease(LEAD) indications. Helixmith is entitled to royalties of either 4% of gross sales or 7% of net sales, whichever is higher, for seven years after launch.

“Helixmith and Biosolution have multiple opportunities for synergy,” a Biosolution official said.

Hugel: Foreign Buying Lifts Shares Despite Volatility

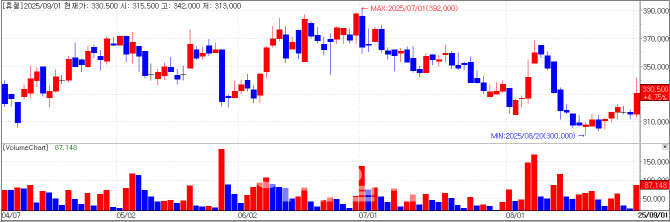

Hugel, a botulinum toxin maker, closed at 330,500 won on Monday, up 4.75% on turnover of 8.7 million shares worth 28.8 billion won. Foreign investors were net buyers of 4,500 shares, offsetting domestic investors’ net sales of about 14,000 shares.

With no new disclosures or press releases, the stock’s volatility stood out. Foreign ownership now accounts for 55.7% of Hugel’s shares. Its largest shareholder is Aphrodite Acquisition Holdings (43.53%), backed by Singapore’s CBC Group (42.11%), a GS Group and IMM Investment SPC (42.11%), and Mubadala’s investment arm (10.53%).

For the first half of 2025, Hugel posted revenue of 200 billion won, up 17% year-on-year, and operating profit of 95.6 billion won, up 44%. Hugel remains the only Korean botulinum toxin company with regulatory approvals across the U.S., China, and Europe.

A Hugel spokesperson said the day’s rally “appears to be driven by market supply-demand dynamics.”

|

Shares of Seers Technology closed at 54,200 won on Monday, up 10.61% (5,200 won) from the previous session, according to KG Zeroin MP Doctor. The company’s market capitalization surged to 686.5 billion won -- triple the level at its IPO a year ago.

Seers Technology offers real-time monitoring of inpatients’ biosignals through wearable ECG patches, with AI-powered predictive analysis to detect early warning signs. Its reimbursement-based revenue-sharing model with hospitals has been cited as a strength in monetization.

CEO Lee Young-shin told PharmEdaily that while multiple factors likely influenced the day’s rally, “expectations for second-half and next year’s earnings appear to be reflected,” adding that “overseas business momentum remains, and investors are looking ahead to details yet to be disclosed.”

Separately, Winvest Venture Partners, an early investor, sold 208,496 shares on the open market between July 11 and August 28 at 17,000 won apiece, raising about 3.5 billion won. Its stake in Seers Technology has since dropped from 7.81% to 6.11%.

|

Helixmith shares climbed 10.07% to close at 6,560 won on Monday, doubling its market cap to 302.4 billion won in just a month. The company has been restructuring since Biosolution became its largest shareholder in December 2023, bringing in a new management team.

A major catalyst is the progress of VM202 (Engensis), licensed to Beijing Northland Biotech back in July 2004. Nearly two decades later, the gene therapy candidate, developed as “NL003” in China, has completed Phase 3 trials for critical limb ischemia and is awaiting regulatory approval.

While contract details are undisclosed, Northland secured rights limited to lower-extremity artery disease(LEAD) indications. Helixmith is entitled to royalties of either 4% of gross sales or 7% of net sales, whichever is higher, for seven years after launch.

“Helixmith and Biosolution have multiple opportunities for synergy,” a Biosolution official said.

|

Hugel, a botulinum toxin maker, closed at 330,500 won on Monday, up 4.75% on turnover of 8.7 million shares worth 28.8 billion won. Foreign investors were net buyers of 4,500 shares, offsetting domestic investors’ net sales of about 14,000 shares.

With no new disclosures or press releases, the stock’s volatility stood out. Foreign ownership now accounts for 55.7% of Hugel’s shares. Its largest shareholder is Aphrodite Acquisition Holdings (43.53%), backed by Singapore’s CBC Group (42.11%), a GS Group and IMM Investment SPC (42.11%), and Mubadala’s investment arm (10.53%).

For the first half of 2025, Hugel posted revenue of 200 billion won, up 17% year-on-year, and operating profit of 95.6 billion won, up 44%. Hugel remains the only Korean botulinum toxin company with regulatory approvals across the U.S., China, and Europe.

A Hugel spokesperson said the day’s rally “appears to be driven by market supply-demand dynamics.”