OncoCross, HLB Rise on R&D Momentum; Shinpoong Sinks[K-Bio Pulse]

created on 05/29/2025 7:54:22 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 05/29/2025 7:54:22 AM

Subscribe

[Seungkwon Kim, Edaily Reporter] Shares of South Korean biotech firms diverged sharply 28, as investors reacted to clinical data announcements and corporate governance concerns.

OncoCross Rallies on AI-Powered Liquid Biopsy Outlook

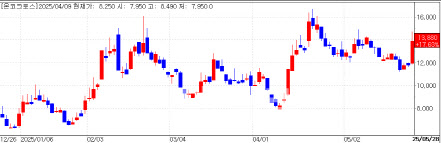

Shares of OncoCross, an artificial intelligence (AI)-driven drug development company, jumped 17.63% to close at 13,880 won, up 2,080 won from the previous session, according to data from KG Zeroin. The stock opened at 11,960 won and reached as high as 14,300 won during the session, bringing its market capitalization to 165.1 billion won.

The surge follows investor optimism surrounding its expansion into AI-based liquid biopsy diagnostics. OncoCross previously revealed plans to unveil clinical data at the American Society of Clinical Oncology (ASCO) 2025 conference in Chicago, taking place from May 30 to June 3.

The company is set to present a poster on a non-invasive, metabolite-based biomarker approach for early detection of cervical intraepithelial neoplasia (CIN) and cervical cancer. Using proprietary AI algorithms, OncoCross identified key metabolites that effectively distinguish between healthy individuals and patients.

Based on a study involving blood samples from 316 individuals, the diagnostic method achieved sensitivity of 94.5% for cervical cancer and 95.9% for CIN, with 95.0% specificity for both. The company aims to further refine the AI algorithms through additional clinical research to improve accuracy and reliability.

“This ASCO 2025 acceptance demonstrates that our AI-powered metabolite diagnostic approach may overcome the limitations of existing cancer diagnostics,” an OncoCross spokesperson said. “Its strong performance even in pre-cancerous conditions differentiates it from current methods.”

HLB Therapeutics Gains on Eye Disease Drug Potential

HLB Therapeutics also saw its stock rise nearly 10% to 8,470 won, driven by growing anticipation for its neurotrophic keratitis (NK) treatment. The rally follows comments from Hynda Kleinman, Chief Scientific Officer at HLB’s U.S. subsidiary ReGenTree, who said a licensing deal for its lead candidate RGN-259 is nearing completion.

Kleinman, a 31-year veteran of the U.S. National Institutes of Health, noted heightened interest from global pharmaceutical companies. RGN-259 is based on thymosin beta-4, a naturally occurring peptide known for promoting cell migration and anti-inflammatory effects.

Unlike the only currently approved NK treatment, Oxervate by Italy’s Domp, RGN-259 not only aids corneal healing but also promotes nerve regeneration and stem cell recruitment. It also offers improved convenience requiring five daily doses at room temperature, compared to Oxervate’s six daily refrigerated doses.

ReGenTree’s upcoming Phase 3 clinical trial results in Europe, due in June, are expected to boost prospects for a lucrative licensing agreement. Oxervate generated over $1 billion in U.S. sales in 2023 and is forecasted to reach $1.2 billion this year.

Shinpoong Pharma Falls on Legal Troubles

Meanwhile, shares of Shinpoong Pharmaceutical tumbled nearly 10%, with its preferred stock dropping about 13%. The losses reflect investor unease following the confirmation of legal penalties against a former executive and renewed speculation over ownership issues.

The Supreme Court earlier this month upheld a prison sentence for former CEO Jang Won-jun, convicted of embezzling company funds. Jang, son of Shinpoong’s founder, also faces ongoing investigations for allegedly dumping shares before the public disclosure of clinical trial failures ? avoiding significant financial losses.

Shinpoong briefly saw gains on renewed COVID-19 concerns in China but quickly reversed course amid sustained governance risk. The company’s market cap stands at approximately 581.8 billion won.

OncoCross Rallies on AI-Powered Liquid Biopsy Outlook

Shares of OncoCross, an artificial intelligence (AI)-driven drug development company, jumped 17.63% to close at 13,880 won, up 2,080 won from the previous session, according to data from KG Zeroin. The stock opened at 11,960 won and reached as high as 14,300 won during the session, bringing its market capitalization to 165.1 billion won.

|

The company is set to present a poster on a non-invasive, metabolite-based biomarker approach for early detection of cervical intraepithelial neoplasia (CIN) and cervical cancer. Using proprietary AI algorithms, OncoCross identified key metabolites that effectively distinguish between healthy individuals and patients.

Based on a study involving blood samples from 316 individuals, the diagnostic method achieved sensitivity of 94.5% for cervical cancer and 95.9% for CIN, with 95.0% specificity for both. The company aims to further refine the AI algorithms through additional clinical research to improve accuracy and reliability.

“This ASCO 2025 acceptance demonstrates that our AI-powered metabolite diagnostic approach may overcome the limitations of existing cancer diagnostics,” an OncoCross spokesperson said. “Its strong performance even in pre-cancerous conditions differentiates it from current methods.”

HLB Therapeutics Gains on Eye Disease Drug Potential

HLB Therapeutics also saw its stock rise nearly 10% to 8,470 won, driven by growing anticipation for its neurotrophic keratitis (NK) treatment. The rally follows comments from Hynda Kleinman, Chief Scientific Officer at HLB’s U.S. subsidiary ReGenTree, who said a licensing deal for its lead candidate RGN-259 is nearing completion.

|

Unlike the only currently approved NK treatment, Oxervate by Italy’s Domp, RGN-259 not only aids corneal healing but also promotes nerve regeneration and stem cell recruitment. It also offers improved convenience requiring five daily doses at room temperature, compared to Oxervate’s six daily refrigerated doses.

ReGenTree’s upcoming Phase 3 clinical trial results in Europe, due in June, are expected to boost prospects for a lucrative licensing agreement. Oxervate generated over $1 billion in U.S. sales in 2023 and is forecasted to reach $1.2 billion this year.

Shinpoong Pharma Falls on Legal Troubles

Meanwhile, shares of Shinpoong Pharmaceutical tumbled nearly 10%, with its preferred stock dropping about 13%. The losses reflect investor unease following the confirmation of legal penalties against a former executive and renewed speculation over ownership issues.

The Supreme Court earlier this month upheld a prison sentence for former CEO Jang Won-jun, convicted of embezzling company funds. Jang, son of Shinpoong’s founder, also faces ongoing investigations for allegedly dumping shares before the public disclosure of clinical trial failures ? avoiding significant financial losses.

Shinpoong briefly saw gains on renewed COVID-19 concerns in China but quickly reversed course amid sustained governance risk. The company’s market cap stands at approximately 581.8 billion won.

김승권 peace@

![[바이오맥짚기]'액체생검' 온코크로스, 주가 급등...'오너리스크' 신풍제약은 급락](https://image.edaily.co.kr/images/vision/files/NP/S/2025/05/PS25052900298b.jpg)