Clinical Results Drive Gains for Ensol Biosciences and ImmunOncia [K-Bio Pulse]

created on 07/11/2025 8:35:06 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 07/11/2025 8:35:06 AM

Subscribe

[Yu Jin-hee, Edaily Reporter] SEOUL, South Korea-On June 9On July 10, the South Korean stock market spotlighted companies in the pharmaceutical, biotech, and medical device sectors that delivered tangible clinical outcomes. Notably, Ensol Biosciences, listed on the relatively low-volume KONEX market, posted a significant rally and further announced post-market financing, hinting at additional upside potential.

According to MP Doctor (formerly MarketPoint) by KG Zeroin, biotech names dominated the day’s top gainers. ImmunOncia and LegoChem Biosciences featured prominently among the KOSDAQ leaders, while KONEX heavyweight Ensol Biosciences surged sharply.

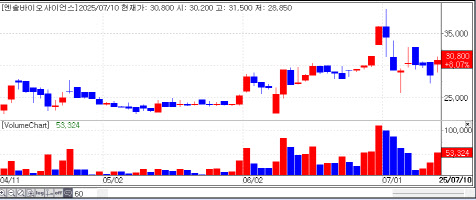

Shares of ImmunOncia rose 19.50% to 5,700 KRW, LegoChem gained 16.90% to 141,800 KRW, and Ensol Biosciences closed up 8.07% at 30,800 KRW.

Ensol Biosciences at one point soared over 10%, invigorating the KONEX market, where the daily upper limit is 15%. Market observers attributed the uptick partly to PharmEdaily’s exclusive premium coverage, “Ensol Biosciences Deep Dive,” a three-part special, including “Co-CEOs Kim Hae-jin and Hyeong In-woo Join Forces.” This series was made freely available via major portals like Naver at 8 a.m. on the same day.

Ensol Biosciences focuses on tackling diseases with no existing therapeutic solutions. Its key pipeline includes: P2K for degenerative disc disease, E1K for osteoarthritis, M1K for Alzheimer’s, D1K an anti-cancer candidate.

A topline readout of P2K’s Phase 3 clinical trial in the U.S. is expected soon, with market sentiment leaning optimistic. This is bolstered by the positioning of Spine BioPharma, the U.S.-based trial sponsor. CEO Marc R. Viscogliosi, speaking at the Canaccord Genuity 2025 Musculoskeletal Conference in San Diego, stated that P2K could potentially be expanded to other spinal and systemic disorders. He also noted plans to initiate trials targeting early-stage patients.

The ongoing Phase 3 trial for P2K targets patients with severe pain and significant functional impairment. Originally discovered by Ensol in 2009–2010, the candidate was licensed out to Yuhan Corp. in 2018 and subsequently transferred to Spine BioPharma under a deal valued at up to $218.15 million (approx. KRW 300 billion).

After market close, Smart&Growth CEO Hyeong In-woo Ensol’s largest shareholder announced an additional KRW 20 billion (approx. $14.5 million) investment in the company. The funding will primarily support the Phase 3 trial of osteoarthritis drug E1K, considered Ensol’s next flagship pipeline.

Last month, Hyeong became the largest shareholder by acquiring Yuhan Corp.’s entire stake in Ensol. E1K, composed of five amino acids, selectively inhibits phosphorylation of the TGF-β downstream signal Smad1/5/8 to regenerate cartilage. It also reduces expression of TGF-β1-induced NGF genes to relieve pain. The Phase 3 trial for E1K is expected to take three years, with a potential Korean launch around 2028. Currently, no truly effective osteoarthritis treatments exist.

An Ensol spokesperson noted that Spine BioPharma has committed to disclosing the P2K Phase 3 results by August. If positive, the company plans to resume its postponed KOSDAQ listing process.

Yuhan Corp. subsidiary ImmunOncia rose for a second consecutive session after reporting it had received the clinical study report (CSR) for Phase 2 trials of IMC-001, a monotherapy for relapsed/refractory NK/T-cell lymphoma. The trial showed strong efficacy and safety: Objective Response Rate (ORR): 79%, Complete Response (CR) Rate: 58%, One-year survival: 85%, Two-year survival: 74%.

Additionally, 22% of patients remained on treatment for over two years, and 26% had already passed the one-year mark. NK/T-cell lymphoma, a rare hematologic cancer that arises outside lymph nodes, currently lacks a standard therapy. ImmunOncia CEO Kim Heung-tae stated the company plans to seek South Korean orphan drug designation for IMC-001 in October, while simultaneously pursuing global license-out discussions.

Meanwhile, LegoChem Biosciences continued its upward momentum, despite no fresh news. The company is widely regarded as a low-risk, mid-return play in the ongoing biotech rally. LegoChem is focused on next-generation antibody-drug conjugate (ADC) development using its proprietary ConjuALL platform. Its lead candidates include HER2-ADC and ROR1-ADC, which are gaining traction in global trials.

On the flip side, Intocell once again hit a lower limit following the previous day’s slump. The decline was triggered by the termination of a licensing deal with ABL Bio due to a patent issue. Despite the company’s assertion that the risk of further patent complications is minimal, investor sentiment remained unshakenly negative.

|

According to MP Doctor (formerly MarketPoint) by KG Zeroin, biotech names dominated the day’s top gainers. ImmunOncia and LegoChem Biosciences featured prominently among the KOSDAQ leaders, while KONEX heavyweight Ensol Biosciences surged sharply.

Shares of ImmunOncia rose 19.50% to 5,700 KRW, LegoChem gained 16.90% to 141,800 KRW, and Ensol Biosciences closed up 8.07% at 30,800 KRW.

Ensol Biosciences at one point soared over 10%, invigorating the KONEX market, where the daily upper limit is 15%. Market observers attributed the uptick partly to PharmEdaily’s exclusive premium coverage, “Ensol Biosciences Deep Dive,” a three-part special, including “Co-CEOs Kim Hae-jin and Hyeong In-woo Join Forces.” This series was made freely available via major portals like Naver at 8 a.m. on the same day.

Ensol Biosciences focuses on tackling diseases with no existing therapeutic solutions. Its key pipeline includes: P2K for degenerative disc disease, E1K for osteoarthritis, M1K for Alzheimer’s, D1K an anti-cancer candidate.

A topline readout of P2K’s Phase 3 clinical trial in the U.S. is expected soon, with market sentiment leaning optimistic. This is bolstered by the positioning of Spine BioPharma, the U.S.-based trial sponsor. CEO Marc R. Viscogliosi, speaking at the Canaccord Genuity 2025 Musculoskeletal Conference in San Diego, stated that P2K could potentially be expanded to other spinal and systemic disorders. He also noted plans to initiate trials targeting early-stage patients.

The ongoing Phase 3 trial for P2K targets patients with severe pain and significant functional impairment. Originally discovered by Ensol in 2009–2010, the candidate was licensed out to Yuhan Corp. in 2018 and subsequently transferred to Spine BioPharma under a deal valued at up to $218.15 million (approx. KRW 300 billion).

After market close, Smart&Growth CEO Hyeong In-woo Ensol’s largest shareholder announced an additional KRW 20 billion (approx. $14.5 million) investment in the company. The funding will primarily support the Phase 3 trial of osteoarthritis drug E1K, considered Ensol’s next flagship pipeline.

Last month, Hyeong became the largest shareholder by acquiring Yuhan Corp.’s entire stake in Ensol. E1K, composed of five amino acids, selectively inhibits phosphorylation of the TGF-β downstream signal Smad1/5/8 to regenerate cartilage. It also reduces expression of TGF-β1-induced NGF genes to relieve pain. The Phase 3 trial for E1K is expected to take three years, with a potential Korean launch around 2028. Currently, no truly effective osteoarthritis treatments exist.

An Ensol spokesperson noted that Spine BioPharma has committed to disclosing the P2K Phase 3 results by August. If positive, the company plans to resume its postponed KOSDAQ listing process.

|

Yuhan Corp. subsidiary ImmunOncia rose for a second consecutive session after reporting it had received the clinical study report (CSR) for Phase 2 trials of IMC-001, a monotherapy for relapsed/refractory NK/T-cell lymphoma. The trial showed strong efficacy and safety: Objective Response Rate (ORR): 79%, Complete Response (CR) Rate: 58%, One-year survival: 85%, Two-year survival: 74%.

Additionally, 22% of patients remained on treatment for over two years, and 26% had already passed the one-year mark. NK/T-cell lymphoma, a rare hematologic cancer that arises outside lymph nodes, currently lacks a standard therapy. ImmunOncia CEO Kim Heung-tae stated the company plans to seek South Korean orphan drug designation for IMC-001 in October, while simultaneously pursuing global license-out discussions.

Meanwhile, LegoChem Biosciences continued its upward momentum, despite no fresh news. The company is widely regarded as a low-risk, mid-return play in the ongoing biotech rally. LegoChem is focused on next-generation antibody-drug conjugate (ADC) development using its proprietary ConjuALL platform. Its lead candidates include HER2-ADC and ROR1-ADC, which are gaining traction in global trials.

On the flip side, Intocell once again hit a lower limit following the previous day’s slump. The decline was triggered by the termination of a licensing deal with ABL Bio due to a patent issue. Despite the company’s assertion that the risk of further patent complications is minimal, investor sentiment remained unshakenly negative.

유진희 sadend@

![Clinical Results Drive Gains for Ensol Biosciences and ImmunOncia [K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/07/PS25071100235b.jpg)

![인투셀, 특허이슈에 장외 하한가…퓨쳐켐, 진단제 국내 품목허가 추진[바이오 맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/07/PS25071000247b.jpg)