PharmaResearch Rallies Upon Scrapping Spin-off; Orum and Y-Biologics gains[K-Bio Pulse]

created on 07/09/2025 7:51:02 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 07/09/2025 7:51:02 AM

Subscribe

[Lim Jeong-yeo, Edaily Reporter] South Korea’s biopharma stocks saw upward momentum, on July 8, accentuated by PharmaResearch, Orum Therapeutics, and Y-Biologics. PharmaResearch rebounded after scrapping its spin-off plan. Orum gained traction on news that its out-licensed partner expanded clinical sites, signaling stable pipeline progress. Y-Biologics’ intentions for multi-specific antibody development boosted corporate value.

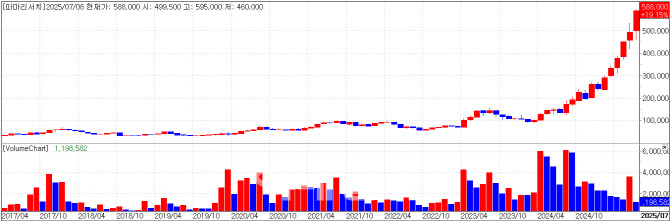

PharmaResearch Scraps Spin-Off, Shares Surge

PharmaResearch on Tuesday announced withdrawal of its planned spin-off, just a month after unveiling a shift to a holding company structure via a vertical split. The stock surged 13.73% to close at KRW 588,000, recovering from previous investor backlash over the proposed 74:25 split ratio.

PharmaResearch had initially planned to spin off its core revenue-generating Rejuran business into a new entity, leaving the remaining company as a holding firm to pursue new investments and strategic M&As. However, the announcement triggered a 17% stock drop on that day, as criticism mounted that the move was more driven to enhance the controlling shareholder’s grip than boosting corporate competitiveness.

In retracting the plan, the company cited “a wide range of feedback regarding governance risks, potential shareholder value dilution, and insufficient communication.”

Must Asset Management, which had issued three public letters opposing the plan, responded positively: “We sincerely thank Chairman Sang-soo Jeong and PharmaResearch’s leadership for heeding shareholders. This is a meaningful step forward for governance reform in Korea’s capital markets.”

Orum Rises on BMS Trial Site Expansion

Shares of Orum Therapeutics climbed 10.47% to KRW 21,100 following updates on its licensed-out asset to Bristol Myers Squibb (BMS). The clinical development of ORM-6151(BMS-986497), a blood cancer therapeutic, is reportedly progressing steadily.

Orum licensed ORM-6151 to BMS in October 2023 in a deal worth up to $180 million (KRW 240 billion), including a $13.52 billion upfront payment. The candidate is a DAC (Degrader-Antibody Conjugate) composed of a CD33 antibody linked to a GSPT1 degrader. Recently, BMS expanded the trial by adding four new clinical sites in France and Spain and introduced new cohorts involving dual combination with azacitidine and a triple combo with azacitidine and venetoclax, alongside the monotherapy arm.

The ongoing Phase 1 trial targets relapsed or refractory AML (acute myeloid leukemia) and MDS (myelodysplastic syndrome), with enrollment having begun in May 2023. Primary completion is estimated by February 2027, and study completion by September 2030.

While Orum discontinued clinical development of its lead pipeline ORM-5029 in April due to an SAE-related patient death from liver failure during a trial last November, the continued advancement of ORM-6151 under BMS’s management is seen as validation of its TPD²-GSPT1 platform technology, which underpins both programs.

An Orum representative commented, “The news about BMS’s smooth clinical progress appears to have positively impacted investor sentiment.”

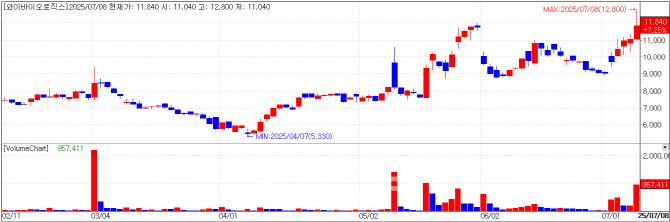

Y-Biologics Transitions from Platform to Therapeutics Developer

Y-Biologics, previously known for its antibody design services, is transitioning into a full-fledged drug developer. The company is ramping up investor engagement, holding more IR briefings and drawing growing market attention. Its stock rose 7.25% to close at KRW 11,840 on Tuesday.

The firm is developing a bispecific antibody-cytokine conjugate that simultaneously blocks two immune checkpoints, including PD-1. Earlier this month, it was selected as the lead R&D organization for a national biopharma technology program by the Ministry of Trade, Industry and Energy. Co-developers include the Osong Medical Innovation Foundation, Samsung Medical Center, KRIBB, and the National Institute of Toxicological Research.

The five-year project, spanning April 2025 to end-2029, has a total budget of KRW 7.4 billion, with KRW 3.1 billion earmarked for Y-Biologics. The aim is to establish a manufacturing process for high-quality, multi-target immuno-oncology biobetters and file an IND for a Phase 1 trial.

As of end-March, the company held just over KRW 10 billion in cash equivalents, including short-term financial instruments, and is expected to secure additional funding for clinical development.

“We’re leaning toward convertible bonds (CBs) rather than a rights offering,” a company official stated, noting that talks with institutional investors are ongoing.

|

PharmaResearch on Tuesday announced withdrawal of its planned spin-off, just a month after unveiling a shift to a holding company structure via a vertical split. The stock surged 13.73% to close at KRW 588,000, recovering from previous investor backlash over the proposed 74:25 split ratio.

PharmaResearch had initially planned to spin off its core revenue-generating Rejuran business into a new entity, leaving the remaining company as a holding firm to pursue new investments and strategic M&As. However, the announcement triggered a 17% stock drop on that day, as criticism mounted that the move was more driven to enhance the controlling shareholder’s grip than boosting corporate competitiveness.

In retracting the plan, the company cited “a wide range of feedback regarding governance risks, potential shareholder value dilution, and insufficient communication.”

Must Asset Management, which had issued three public letters opposing the plan, responded positively: “We sincerely thank Chairman Sang-soo Jeong and PharmaResearch’s leadership for heeding shareholders. This is a meaningful step forward for governance reform in Korea’s capital markets.”

|

Shares of Orum Therapeutics climbed 10.47% to KRW 21,100 following updates on its licensed-out asset to Bristol Myers Squibb (BMS). The clinical development of ORM-6151(BMS-986497), a blood cancer therapeutic, is reportedly progressing steadily.

Orum licensed ORM-6151 to BMS in October 2023 in a deal worth up to $180 million (KRW 240 billion), including a $13.52 billion upfront payment. The candidate is a DAC (Degrader-Antibody Conjugate) composed of a CD33 antibody linked to a GSPT1 degrader. Recently, BMS expanded the trial by adding four new clinical sites in France and Spain and introduced new cohorts involving dual combination with azacitidine and a triple combo with azacitidine and venetoclax, alongside the monotherapy arm.

The ongoing Phase 1 trial targets relapsed or refractory AML (acute myeloid leukemia) and MDS (myelodysplastic syndrome), with enrollment having begun in May 2023. Primary completion is estimated by February 2027, and study completion by September 2030.

While Orum discontinued clinical development of its lead pipeline ORM-5029 in April due to an SAE-related patient death from liver failure during a trial last November, the continued advancement of ORM-6151 under BMS’s management is seen as validation of its TPD²-GSPT1 platform technology, which underpins both programs.

An Orum representative commented, “The news about BMS’s smooth clinical progress appears to have positively impacted investor sentiment.”

|

Y-Biologics, previously known for its antibody design services, is transitioning into a full-fledged drug developer. The company is ramping up investor engagement, holding more IR briefings and drawing growing market attention. Its stock rose 7.25% to close at KRW 11,840 on Tuesday.

The firm is developing a bispecific antibody-cytokine conjugate that simultaneously blocks two immune checkpoints, including PD-1. Earlier this month, it was selected as the lead R&D organization for a national biopharma technology program by the Ministry of Trade, Industry and Energy. Co-developers include the Osong Medical Innovation Foundation, Samsung Medical Center, KRIBB, and the National Institute of Toxicological Research.

The five-year project, spanning April 2025 to end-2029, has a total budget of KRW 7.4 billion, with KRW 3.1 billion earmarked for Y-Biologics. The aim is to establish a manufacturing process for high-quality, multi-target immuno-oncology biobetters and file an IND for a Phase 1 trial.

As of end-March, the company held just over KRW 10 billion in cash equivalents, including short-term financial instruments, and is expected to secure additional funding for clinical development.

“We’re leaning toward convertible bonds (CBs) rather than a rights offering,” a company official stated, noting that talks with institutional investors are ongoing.

임정요 kaylalim@

![파마리서치 인적분할 철회에 상승, 오름·와이바이오 훈풍[바이오 맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/07/PS25070901188b.jpg)