Limit-Up L&C Bio: “No CAPA Issues”; Lituo Shortage Easing Soon[K-Bio Pulse]

created on 09/08/2025 9:30:42 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 09/08/2025 9:30:42 AM

Subscribe

[NA Eun-kyung, Edaily Reporter] Sept. 5. Korean pharma, biotech and healthcare stocks were mixed Friday as L&C Bio surged on reports of a sellout of its skin-booster product, while Cellbion extended losses after releasing Phase 2 data for its prostate cancer candidate.

L&C Bio Soars on Skin Booster Shortage

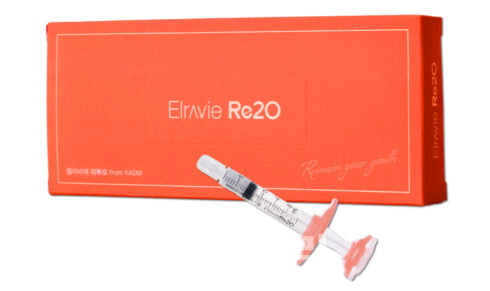

L&C Bio finished up 29.89% at 42,150 won. The rally followed social media posts by a Daegu-based dermatologist noting “Elravie Re2O sold out,” referring to L&C Bio’s skin booster “Elravie Re2O,” launched in Korea in February.

Elravie Re2O is designed to replenish key extracellular matrix components to promote skin regeneration. Its main raw material, human acellular dermal matrix (hADM), is approved by Korea’s Ministry of Food and Drug Safety.

An L&C Bio official said the sudden spike in demand created a short-term mismatch between hospital inventories and distribution timing. “This is not a capacity issue, so the shortage should ease quickly,” the official said.

Elravie Re2O is currently sold in Korea and Singapore. L&C Bio initially projected about 3 billion won in first-year sales but now expects to exceed that figure. The company raised its 2026 target to 9 to 10 billion won and plans to expand exports across Asia, including Southeast Asia.

Humedix rises on distribution link

Humedix, a pharmaceuticals and aesthetics affiliate of Huons and the domestic distributor holding Elravie Re2O rights, rose 14.92%. Humedix focuses on skin aesthetics and maintains a network of more than 3,000 clinics and hospitals in Korea. Of its 2024 revenue of 161.9 billion won, 130.8 billion won (81%) came from in-house products such as fillers and botulinum toxin. As Elravie Re2O sales increase, the company expects merchandise revenue, which currently accounts for 19% of total, to grow as well.

“Despite being in its first year, Elravie Re2O is already used by more than 300 hospitals and large dermatology chains,” said Lee Seung-eun, an analyst at Yuanta Securities. Lee called it a strategic product that can replace or complement existing skin boosters and biostimulators.

Brokerage estimates put Humedix’s first-year Elravie Re2O sales at roughly 8 to 10 billion won. In the second quarter, Elravie Re2O partially offset a decline in botulinum-toxin revenue amid heightened competition. Because Elravie Re2O carries the highest margin among merchandise lines, analysts expect it to lift Humedix’s profitability.

Humedix said it aims to expand the market quickly with academic marketing, including conferences and symposia to share evidence on Elravie Re2O’s efficacy.

Cellbion falls for a second day

Radiopharmaceutical developer Cellbion closed down 21.15% at 22,000 won, following a 13% decline Thursday on the NXT alternative trading system after the company reported Phase 2 results post-close on Sept. 4 for Lu-177-DGUL, its candidate for metastatic castration-resistant prostate cancer(mCRPC).

Of 91 enrolled patients, 78 were evaluable for tumor response. The objective response rate (ORR) on the primary endpoint was 35.90% (28 of 78), including complete responses of 8.97% and partial responses of 26.92%. The final ORR was lower than the previously announced interim figure of 47.54%, which weighed on sentiment.

In an interview with PharmEdaily(Cellbion’s radiotherapy shows 35% ORR, looks to expand Merck ties), CEO Kim said the interim analysis excluded patients who refused further treatment after a first dose, died of causes such as COVID-19, or declined life-sustaining care. The independent imaging review committee later applied stricter criteria and included many of those patients, which reduced the final ORR.

On Friday afternoon, Cellbion posted on its website a comparison of Lu-177-DGUL with Novartis’s Pluvicto, citing higher ORR versus data from a Japanese bridging study and asserting that its candidate could be “best-in-class.” The company’s comparison reflects its own analysis.

L&C Bio Soars on Skin Booster Shortage

L&C Bio finished up 29.89% at 42,150 won. The rally followed social media posts by a Daegu-based dermatologist noting “Elravie Re2O sold out,” referring to L&C Bio’s skin booster “Elravie Re2O,” launched in Korea in February.

|

Elravie Re2O is designed to replenish key extracellular matrix components to promote skin regeneration. Its main raw material, human acellular dermal matrix (hADM), is approved by Korea’s Ministry of Food and Drug Safety.

An L&C Bio official said the sudden spike in demand created a short-term mismatch between hospital inventories and distribution timing. “This is not a capacity issue, so the shortage should ease quickly,” the official said.

Elravie Re2O is currently sold in Korea and Singapore. L&C Bio initially projected about 3 billion won in first-year sales but now expects to exceed that figure. The company raised its 2026 target to 9 to 10 billion won and plans to expand exports across Asia, including Southeast Asia.

Humedix rises on distribution link

Humedix, a pharmaceuticals and aesthetics affiliate of Huons and the domestic distributor holding Elravie Re2O rights, rose 14.92%. Humedix focuses on skin aesthetics and maintains a network of more than 3,000 clinics and hospitals in Korea. Of its 2024 revenue of 161.9 billion won, 130.8 billion won (81%) came from in-house products such as fillers and botulinum toxin. As Elravie Re2O sales increase, the company expects merchandise revenue, which currently accounts for 19% of total, to grow as well.

“Despite being in its first year, Elravie Re2O is already used by more than 300 hospitals and large dermatology chains,” said Lee Seung-eun, an analyst at Yuanta Securities. Lee called it a strategic product that can replace or complement existing skin boosters and biostimulators.

Brokerage estimates put Humedix’s first-year Elravie Re2O sales at roughly 8 to 10 billion won. In the second quarter, Elravie Re2O partially offset a decline in botulinum-toxin revenue amid heightened competition. Because Elravie Re2O carries the highest margin among merchandise lines, analysts expect it to lift Humedix’s profitability.

Humedix said it aims to expand the market quickly with academic marketing, including conferences and symposia to share evidence on Elravie Re2O’s efficacy.

Cellbion falls for a second day

Radiopharmaceutical developer Cellbion closed down 21.15% at 22,000 won, following a 13% decline Thursday on the NXT alternative trading system after the company reported Phase 2 results post-close on Sept. 4 for Lu-177-DGUL, its candidate for metastatic castration-resistant prostate cancer(mCRPC).

Of 91 enrolled patients, 78 were evaluable for tumor response. The objective response rate (ORR) on the primary endpoint was 35.90% (28 of 78), including complete responses of 8.97% and partial responses of 26.92%. The final ORR was lower than the previously announced interim figure of 47.54%, which weighed on sentiment.

In an interview with PharmEdaily(Cellbion’s radiotherapy shows 35% ORR, looks to expand Merck ties), CEO Kim said the interim analysis excluded patients who refused further treatment after a first dose, died of causes such as COVID-19, or declined life-sustaining care. The independent imaging review committee later applied stricter criteria and included many of those patients, which reduced the final ORR.

On Friday afternoon, Cellbion posted on its website a comparison of Lu-177-DGUL with Novartis’s Pluvicto, citing higher ORR versus data from a Japanese bridging study and asserting that its candidate could be “best-in-class.” The company’s comparison reflects its own analysis.

![Biopharma Earnings Drive Undervalued Stocks Higher, L&C Bio Extends Rally[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/09/PS25090900399b.jpg)

![셀트리온, 관세 위험 뚫는다[인베스트 바이오]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/09/PS25090700347b.jpg)

![‘상한가’ 엘앤씨바이오 “CAPA 문제없어…리투오 품귀, 곧 해소”[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/09/PS25090800077b.jpg)