P Ildong Joins Obesity Drug Race; Alteogen Floats KOSPI Relisting[K-Bio Pulse]

created on 07/08/2025 7:59:00 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 07/08/2025 7:59:00 AM

Subscribe

[Lim Jeong-yeo, Edaily Reporter] South Korea’s biopharma stock market drew investor attention on July 7 with notable price movements from Ildong Pharmaceutical, Hyundai Bioscience, and Alteogen. Ildong gained traction following announcement of obesity drug development, while Alteogen surged after its second-largest shareholder hinted at a potential KOSPI relisting.

Ildong Pharmaceutical Rides GLP-1 Wave via Subsidiary YUNOVIA

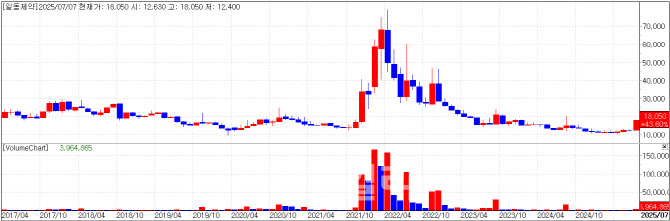

According to KG Zeroin’s MP Doctor (formerly Market Point), both Ildong Pharmaceutical and its holding company Ildong Holdings hit the daily upper price limit. Ildong Pharmaceutical closed at 18,050 KRW (+29.95%, +4,160 KRW), and Ildong Holdings at 9,540 KRW (+29.97%, +2,200 KRW).

Ildong recently showcased R&D progress by its 100% subsidiary, YUNOVIA, at a global conference. At the American Diabetes Association (ADA) conference in Chicago last month, YUNOVIA unveiled part of the Phase 1 clinical trial data for its metabolic disease candidate ID110521156, targeting obesity and diabetes. The compound is a GLP-1 receptor agonist, which mimics the GLP-1 hormone’s roles in insulin production, blood sugar regulation, gastrointestinal motility, and appetite suppression.

Unlike peptide-based injectables, the orally available formulation of ID110521156 offers manufacturing ease and patient convenience, the company said. In 4-week dosing, the cohort that was given 100mg of the drug showed an average weight reduction of 6.9%, peaking at 11.9%. The proportion of participants losing over 5% body weight was 0% in placebo, but 55.6% and 66.7% in the 50mg and 100mg arms, respectively. A multiple ascending dose (MAD) study is underway.

Separately, Ildong announced it would launch Japan’s popular pain-relief patch “Roihi-Tsuboko Coin Plaster” domestically through a license agreement with Nichiban. The product will be distributed exclusively in Korean pharmacies starting this month.

An Ildong spokesperson commented, “We shared R&D updates on our GLP-1 compound and other pipelines at ADA. This seems to have influenced today’s share price. While the data presented were from a brief 4-week study, further dosing and duration may enhance weight loss outcomes. The announcement of the Roihi patch launch likely contributed to today’s market response as well.”

Alteogen Jumps on KOSPI Relisting Talk from Second-Largest Shareholder

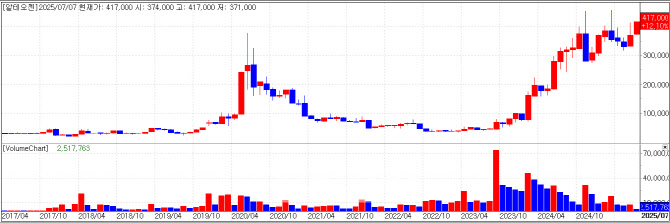

Alteogen shares jumped 11.05% to 417,000 KRW, spurred by Hyung In-woo, CEO of Smart&Growth and the firm’s second-largest shareholder, who floated the idea of a KOSPI relisting via Smart&Growth’s blog.

As of May, Hyung held 2.7 million shares of Alteogen, while his spouse Hye-yoon Yeom held 160,000 shares. The couple’s Alteogen shares together worth roughly 1.19 trillion KRW at the day’s closing price.

On Smart&Growth’s blog, Hyung wrote: “The PGR(post-grant review) challenging competitor patents is progressing smoothly, and U.S. patent registration for ALT-B4 is expected within 2 weeks. If Merck’s subcutaneous(SC) version of Keytruda gains marketing approval in Q3, royalties for Alteogen could flow in sharply from Q4.”

He added, “If this pans out, there appears to be no reason to delay relisting on the bigger KOSPI bourse. If the company remains hesitant even then, I will actively push for the relisting.”

An Alteogen spokesperson said, “Today’s rise appears to stem from Hyung’s remarks. There are no other immediate catalysts. We believe Alteogen’s fundamental value is only improving and will eventually be properly reflected in the stock value.”

Hyundai Bioscience Pivots to Metastatic Cancer After COVID-19 Setback

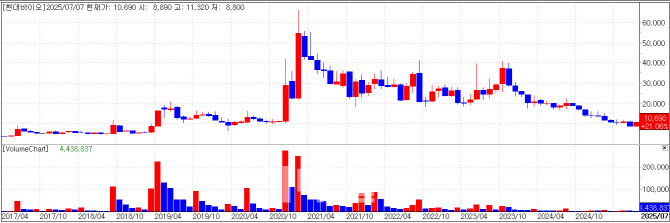

After its COVID-19 drug CP-COV03 was rejected for Phase 3 trials due to incomplete data, Hyundai Bioscience rebounded by unveiling a new focus on metastatic cancer. Shares closed at 10,690 KRW, up 17.99% (+1,630 KRW).

The company announced it will host a press briefing on July 21, where it plans to disclose preclinical data using patient-derived organoids targeting solid tumors with metastasis.

In the study, Hyundai Bioscience combined its oral capsule drug Penetrium with conventional drugs such as Gemcitabine(pancreatic cancer), Bevacizumab(NSCLC), and Paclitaxel(TNBC). It claims these combinations significantly boosted therapeutic efficacy.

The research was conducted with its subsidiary Hyundai ADM Bio, which has applied to the local Ministry of Food and Drug Safety to initiate a Phase 1 trial combining Penetrium with Pembrolizumab(Keytruda).

Hyundai ADM Bio (formerly ADM Korea) was acquired in May 2024 by Hyundai Bioscience, CNPharm, and director Kim Yeon-jin for 31 billion KRW (Hyundai: 27B, CNPharm: 2.5B, Kim: 1.5B). The acquisition was funded in part by a convertible bond (CB) issuance worth 18B KRW, invested in by Sangsangin-affiliated financial firms at a 7% annual coupon, indicating a push for early repayment. Hyundai Bioscience recently paid back 8.5B KRW of this CB.

To fund operations, Hyundai ADM Bio recently closed a paid-in capital increase worth 4B KRW. Shares were allocated to CNPharm and director Kim. The price per share was discounted 10% to 1,327 KRW, based on market averages. Notably, the capital contribution was less than claimed for, as CNPharm gave away Hyundai Bioscience shares instead of cash for the issuance.

CNPharm transferred 258,928 shares of Hyundai Bioscience at 10,250 KRW each, acquiring 2 million new shares of Hyundai ADM Bio in return. Kim secured 1 million shares. Both parties are now subject to a one-year lock-up.

A company representative noted, “At the upcoming event, we will present scientific data addressing the issue of CAF-induced ‘pseudo-resistance.’ The recent CB repayment was initiated by the company, not through the bondholder’s put option.”

|

According to KG Zeroin’s MP Doctor (formerly Market Point), both Ildong Pharmaceutical and its holding company Ildong Holdings hit the daily upper price limit. Ildong Pharmaceutical closed at 18,050 KRW (+29.95%, +4,160 KRW), and Ildong Holdings at 9,540 KRW (+29.97%, +2,200 KRW).

Ildong recently showcased R&D progress by its 100% subsidiary, YUNOVIA, at a global conference. At the American Diabetes Association (ADA) conference in Chicago last month, YUNOVIA unveiled part of the Phase 1 clinical trial data for its metabolic disease candidate ID110521156, targeting obesity and diabetes. The compound is a GLP-1 receptor agonist, which mimics the GLP-1 hormone’s roles in insulin production, blood sugar regulation, gastrointestinal motility, and appetite suppression.

Unlike peptide-based injectables, the orally available formulation of ID110521156 offers manufacturing ease and patient convenience, the company said. In 4-week dosing, the cohort that was given 100mg of the drug showed an average weight reduction of 6.9%, peaking at 11.9%. The proportion of participants losing over 5% body weight was 0% in placebo, but 55.6% and 66.7% in the 50mg and 100mg arms, respectively. A multiple ascending dose (MAD) study is underway.

Separately, Ildong announced it would launch Japan’s popular pain-relief patch “Roihi-Tsuboko Coin Plaster” domestically through a license agreement with Nichiban. The product will be distributed exclusively in Korean pharmacies starting this month.

An Ildong spokesperson commented, “We shared R&D updates on our GLP-1 compound and other pipelines at ADA. This seems to have influenced today’s share price. While the data presented were from a brief 4-week study, further dosing and duration may enhance weight loss outcomes. The announcement of the Roihi patch launch likely contributed to today’s market response as well.”

|

Alteogen shares jumped 11.05% to 417,000 KRW, spurred by Hyung In-woo, CEO of Smart&Growth and the firm’s second-largest shareholder, who floated the idea of a KOSPI relisting via Smart&Growth’s blog.

As of May, Hyung held 2.7 million shares of Alteogen, while his spouse Hye-yoon Yeom held 160,000 shares. The couple’s Alteogen shares together worth roughly 1.19 trillion KRW at the day’s closing price.

On Smart&Growth’s blog, Hyung wrote: “The PGR(post-grant review) challenging competitor patents is progressing smoothly, and U.S. patent registration for ALT-B4 is expected within 2 weeks. If Merck’s subcutaneous(SC) version of Keytruda gains marketing approval in Q3, royalties for Alteogen could flow in sharply from Q4.”

He added, “If this pans out, there appears to be no reason to delay relisting on the bigger KOSPI bourse. If the company remains hesitant even then, I will actively push for the relisting.”

An Alteogen spokesperson said, “Today’s rise appears to stem from Hyung’s remarks. There are no other immediate catalysts. We believe Alteogen’s fundamental value is only improving and will eventually be properly reflected in the stock value.”

|

After its COVID-19 drug CP-COV03 was rejected for Phase 3 trials due to incomplete data, Hyundai Bioscience rebounded by unveiling a new focus on metastatic cancer. Shares closed at 10,690 KRW, up 17.99% (+1,630 KRW).

The company announced it will host a press briefing on July 21, where it plans to disclose preclinical data using patient-derived organoids targeting solid tumors with metastasis.

In the study, Hyundai Bioscience combined its oral capsule drug Penetrium with conventional drugs such as Gemcitabine(pancreatic cancer), Bevacizumab(NSCLC), and Paclitaxel(TNBC). It claims these combinations significantly boosted therapeutic efficacy.

The research was conducted with its subsidiary Hyundai ADM Bio, which has applied to the local Ministry of Food and Drug Safety to initiate a Phase 1 trial combining Penetrium with Pembrolizumab(Keytruda).

Hyundai ADM Bio (formerly ADM Korea) was acquired in May 2024 by Hyundai Bioscience, CNPharm, and director Kim Yeon-jin for 31 billion KRW (Hyundai: 27B, CNPharm: 2.5B, Kim: 1.5B). The acquisition was funded in part by a convertible bond (CB) issuance worth 18B KRW, invested in by Sangsangin-affiliated financial firms at a 7% annual coupon, indicating a push for early repayment. Hyundai Bioscience recently paid back 8.5B KRW of this CB.

To fund operations, Hyundai ADM Bio recently closed a paid-in capital increase worth 4B KRW. Shares were allocated to CNPharm and director Kim. The price per share was discounted 10% to 1,327 KRW, based on market averages. Notably, the capital contribution was less than claimed for, as CNPharm gave away Hyundai Bioscience shares instead of cash for the issuance.

CNPharm transferred 258,928 shares of Hyundai Bioscience at 10,250 KRW each, acquiring 2 million new shares of Hyundai ADM Bio in return. Kim secured 1 million shares. Both parties are now subject to a one-year lock-up.

A company representative noted, “At the upcoming event, we will present scientific data addressing the issue of CAF-induced ‘pseudo-resistance.’ The recent CB repayment was initiated by the company, not through the bondholder’s put option.”

임정요 kaylalim@

![LG 출신 김현수 대표, 독보적 광학 기술로 글로벌시장 접수[휴비츠 대해부①]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/03/PS26030800061b.jpg)