P QuantaMatrix Hits Upper Limit on Growing Order Intake…Aptabio·Alteogen ↑[K-bio Pulse]

created on 07/17/2025 8:13:59 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 07/17/2025 8:13:59 AM

Subscribe

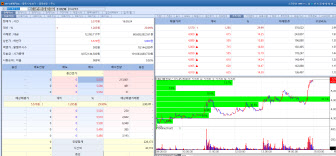

[Shin-Min Joon, Edaily Reporter] On July 16 Korea’s biotech stock market saw QuantaMatrix hitting the daily upper limit. The stock rallied sharply after a Pharmedaily pay to read article reported that the company’s rapid antibiotic susceptibility testing solution is gaining adoption at domestic hospitals fueling expectations of improved earnings.

Aptabio also rose following reports that it is in discussions with global pharma giant GlaxoSmithKline (GSK) for a package licensing deal. Alteogen extended its winning streak for a third session on news that its ALT-B4 hyaluronidase has secured a substance patent in the U.S.

QuantaMatrix Gains on Expanding Hospital Adoption of dRAST

According to KG Zeroin’s MP Doctor (formerly MarketPoint) QuantaMatrix shares jumped 29.99% to close at 5,570 won. Investors attributed the rally to heightened expectations for earnings improvement as QuantaMatrix’s rapid antibiotic susceptibility solution dRAST sees increasing adoption by major Korean hospitals.

dRAST can reduce testing time by 30 to 50 hours compared to conventional antibiotic resistance tests a critical advantage in managing acute infections such as sepsis, where survival rates decrease rapidly over time.

In a PharmEdaily article published today, QuantaMatrix CEO emphasized plans to expand domestic hospital adoption to 20~24 sites by year end.

Although last year’s medical conflict slowed dRAST sales, QuantaMatrix secured four new hospital clients in the first half of 2025 alone. The company’s growing share of consumable sales is also drawing attention, as it could help establish a stable, recurring revenue base. Consumables currently account for 25% of total sales, with a long term target of 70~80%.

On the export front QuantaMatrix is accelerating overseas expansion. In January 2025, it obtained product registration approval from Saudi Arabia’s public procurement body, allowing direct supply to local public hospitals without individual tenders.

In May 2024 it also won an exclusive supply deal with France’s public hospital procurement group. The company is working on cost reduction for its equipment in preparation for commercialization in the U.S. market.

QuantaMatrix also secured fresh funding announcing a 10 billion won private placement with its largest shareholder, Ezra Asset Trust, late last year. As of the first half of this year, 8 billion won has been received, with the remaining amount scheduled for later this year.

A company official commented “Once the ongoing financing is completed, we plan to start clinical trials for U.S. market entry. Rising dRAST sales and improved financing have positively impacted investor sentiment.”

Aptabio Rallies on GSK Package Licensing Talks

Aptabio jumped 10.00% to 10,120 won, buoyed by prospects of a package technology licensing deal involving its contrast-induced acute kidney injury (AKI) treatment and diabetic nephropathy (DN) therapy.

The company hinted at a potential deal during a Korea Exchange corporate briefing, with GlaxoSmithKline reportedly among the global partners in discussion.

Aptabio’s APX-115-DN (for DN) and APX-115-AKI (for AKI) are both first-in-class therapies based on NOX inhibition. APX-115-DN completed Phase 2 in Europe and is undergoing Phase 2b trials in Korea, while APX-115-AKI is in Phase 2 with patient enrollment expected to conclude by October 2025.

Aptabio is also collaborating with Merck & Co. on combination therapies targeting solid tumors, combining Keytruda with Aptabio’s proprietary immune-oncology agent APX-343A.

An Aptabio spokesperson said “We are in discussions with multiple global firms for licensing and joint development of our DN and AKI therapies.”

Alteogen Extends Rally as U.S. Grants ALT-B4 Patent

Alteogen climbed 3.62% to 486,000 won, posting a three day winning streak. The U.S. Patent and Trademark Office has issued a final notice of allowance for the company’s ALT-B4 hyaluronidase substance patent, with official registration expected within three weeks.

The patent covers the differentiation and improvements of ALT-B4, a variant of PH20, reaffirming its novelty and inventive step. With this, Alteogen secures a second U.S. patent following its manufacturing method patent further strengthening ALT-B4’s IP protection in the world’s largest pharmaceutical market.

Alteogen plans to accelerate global partnerships, leveraging its patent portfolio. The U.S. patent is also expected to support regulatory approvals and commercialization.

However the company clarified that the new patent is unrelated to the post grant review (PGR) proceeding filed by Merck & Co. (MSD) against Halozyme’s MDASE patent in which Alteogen is not a party.

Alteogen is currently verifying details with its U.S. subsidiary and plans to issue an official statement once internal confirmation is complete.

A company official noted “Further clarification is still needed before we disclose more information.”

Aptabio also rose following reports that it is in discussions with global pharma giant GlaxoSmithKline (GSK) for a package licensing deal. Alteogen extended its winning streak for a third session on news that its ALT-B4 hyaluronidase has secured a substance patent in the U.S.

|

According to KG Zeroin’s MP Doctor (formerly MarketPoint) QuantaMatrix shares jumped 29.99% to close at 5,570 won. Investors attributed the rally to heightened expectations for earnings improvement as QuantaMatrix’s rapid antibiotic susceptibility solution dRAST sees increasing adoption by major Korean hospitals.

dRAST can reduce testing time by 30 to 50 hours compared to conventional antibiotic resistance tests a critical advantage in managing acute infections such as sepsis, where survival rates decrease rapidly over time.

In a PharmEdaily article published today, QuantaMatrix CEO emphasized plans to expand domestic hospital adoption to 20~24 sites by year end.

Although last year’s medical conflict slowed dRAST sales, QuantaMatrix secured four new hospital clients in the first half of 2025 alone. The company’s growing share of consumable sales is also drawing attention, as it could help establish a stable, recurring revenue base. Consumables currently account for 25% of total sales, with a long term target of 70~80%.

On the export front QuantaMatrix is accelerating overseas expansion. In January 2025, it obtained product registration approval from Saudi Arabia’s public procurement body, allowing direct supply to local public hospitals without individual tenders.

In May 2024 it also won an exclusive supply deal with France’s public hospital procurement group. The company is working on cost reduction for its equipment in preparation for commercialization in the U.S. market.

QuantaMatrix also secured fresh funding announcing a 10 billion won private placement with its largest shareholder, Ezra Asset Trust, late last year. As of the first half of this year, 8 billion won has been received, with the remaining amount scheduled for later this year.

A company official commented “Once the ongoing financing is completed, we plan to start clinical trials for U.S. market entry. Rising dRAST sales and improved financing have positively impacted investor sentiment.”

Aptabio Rallies on GSK Package Licensing Talks

Aptabio jumped 10.00% to 10,120 won, buoyed by prospects of a package technology licensing deal involving its contrast-induced acute kidney injury (AKI) treatment and diabetic nephropathy (DN) therapy.

The company hinted at a potential deal during a Korea Exchange corporate briefing, with GlaxoSmithKline reportedly among the global partners in discussion.

Aptabio’s APX-115-DN (for DN) and APX-115-AKI (for AKI) are both first-in-class therapies based on NOX inhibition. APX-115-DN completed Phase 2 in Europe and is undergoing Phase 2b trials in Korea, while APX-115-AKI is in Phase 2 with patient enrollment expected to conclude by October 2025.

Aptabio is also collaborating with Merck & Co. on combination therapies targeting solid tumors, combining Keytruda with Aptabio’s proprietary immune-oncology agent APX-343A.

An Aptabio spokesperson said “We are in discussions with multiple global firms for licensing and joint development of our DN and AKI therapies.”

Alteogen Extends Rally as U.S. Grants ALT-B4 Patent

Alteogen climbed 3.62% to 486,000 won, posting a three day winning streak. The U.S. Patent and Trademark Office has issued a final notice of allowance for the company’s ALT-B4 hyaluronidase substance patent, with official registration expected within three weeks.

The patent covers the differentiation and improvements of ALT-B4, a variant of PH20, reaffirming its novelty and inventive step. With this, Alteogen secures a second U.S. patent following its manufacturing method patent further strengthening ALT-B4’s IP protection in the world’s largest pharmaceutical market.

Alteogen plans to accelerate global partnerships, leveraging its patent portfolio. The U.S. patent is also expected to support regulatory approvals and commercialization.

However the company clarified that the new patent is unrelated to the post grant review (PGR) proceeding filed by Merck & Co. (MSD) against Halozyme’s MDASE patent in which Alteogen is not a party.

Alteogen is currently verifying details with its U.S. subsidiary and plans to issue an official statement once internal confirmation is complete.

A company official noted “Further clarification is still needed before we disclose more information.”

신민준 adonis@

![i-Sens Soars 23% on EU CGM Expansion [K-bio pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021300327b.jpg)

![아이센스, CGM ‘유럽’ 기대에 23%↑…파미셀, 호실적에 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021300328b.jpg)

![냉탕 온탕 오간 에이프릴바이오…실적 호조에 로킷·휴젤 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021200275b.jpg)