Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 12/30/2025 8:00:06 AM

Subscribe

[Kim Jiwan, Edaily Reporter] South Korea‘s biopharmaceutical sector saw strong momentum on December 29 as companies with platform level or first in class technologies drove investor attention.

ToolGen soared after back-to-back validations of its CRISPR-Cas9 RNP platform technology in the U.S. and Europe. Kangstem Biotech gained on excitement around follicle organoid–based hair-loss drug development and favorable policy sentiment.

AprilBio rallied as competitive setbacks in its drug class helped spotlight its licensed technologies currently in global clinical programs.

ToolGen jumps on U.S. EU patent wins

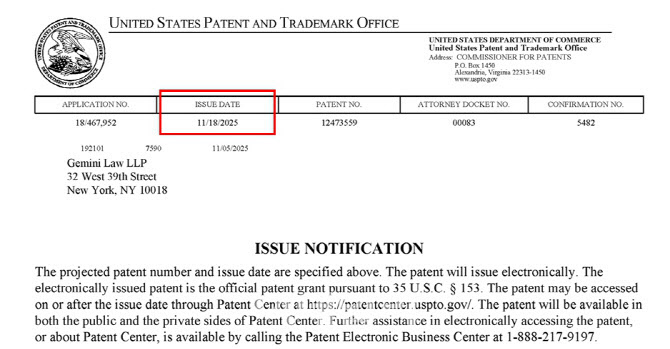

ToolGen climbed 10.5% to won 60,000 after securing consecutive CRISPR-Cas9 RNP intellectual property wins in major jurisdictions. According to KG Zeroin MP Doctor, the company recently obtained a delivery platform patent from the U.S. Patent and Trademark Office followed this month by successful rights defense over plant related RNP IP in Europe.

On December 10, it received an Intention to Grant notice from the European Patent Office regarding a CRISPR RNP patent (EP 4 397 760).

ToolGen’s RNP approach introduces Cas9 protein and guide RNA directly as a complex, minimizing risks of foreign DNA insertion and reducing off target events compared to DNA or mRNA-based delivery. In addition to therapeutic applications the technology is already used in seed and agricultural fields, reinforcing its breadth and commercial relevance.

A key point for investors has been ToolGen‘s success in countering two third party observations filed by Vertex Pharmaceuticals which attempted to weaken ToolGen’s patent position. Having overcome those challenges, ToolGen is now pursuing patent infringement litigation tied to Exa-cel the first globally approved CRISPR therapy. This marks a shift toward proactive enforcement of what it describes as its “rightful business foundation.”

CEO Jong-Sang Yoo emphasized that recognition in both the U.S. and Europe demonstrates differentiation at the technology core. ToolGen‘s CRISPR-Cas9 RNP patent portfolio now spans Korea, the U.S., Europe, Japan, Hong Kong, and Australia, further building competitive barriers in the emerging genome-editing landscape.

Kangstem tied to hair-follicle organoid project

Kangstem Biotech gained 10.9% to won 2,135 amid progress in hair follicle organoid-based drug screening and anticipation linked to national discussions around reimbursement for hair loss treatments. The company announced a joint research agreement with Institut Pasteur Korea to apply its proprietary follicle organoids in external screening programs for the first time.

Under the collaboration, Kangstem supplies organoids that closely reproduce human follicle biology, while Pasteur Korea establishes an evaluation system using its advanced screening capabilities. This model complements traditional 2D cell assays and animal studies by capturing human-specific efficacy and safety information in early development.

Management noted that the technology could improve the likelihood of clinical success for hair-loss candidates and enable screening services organoid based CRO offerings and target discovery businesses.

With organoids widely seen as a higher value market opportunity versus existing artificial skin or 2D platforms investors view the partnership as a concrete step toward revenue generation and broader industry uptake.

AprilBio moves up the queue in TED race

AprilBio advanced 12.9% to won 55,100 as its out licensed programs maintained strategic priority in global pipelines while rival assets lost momentum. Its thyroid eye disease (TED) candidate APB-A1, partnered with Lundbeck is in Phase 1b with interim signals supporting a mid 2025 data readout.

Analysts see the project as having achieved early proof-of-concept suggesting potential expansion into autoimmune disorders such as multiple sclerosis and generalized myasthenia gravis.

Meanwhile, EvoMune is progressing APB-R3 a SAFA platform based asset for atopic dermatitis in Phase 2a with data expected in the first quarter of next year. Success would open pathways into inflammatory bowel diseases including ulcerative colitis and Crohn’s disease, simultaneously strengthening commercial validation of the underlying technology.

Investor optimism has been reinforced by market disruption in the FcRn-inhibitor class, once viewed as a primary TED strategy. Immunovant‘s batoclimab has lost priority in pipeline strategy and Argenx recently halted Phase 3 development of its subcutaneous efgartigimod for TED after an IDMC recommendation.

With FcRn competition weakening APB-A1 which targets the CD40L pathway has drawn attention as a differentiated mechanism that may offer a more favorable safety profile and support therapeutic diversification in TED.

Industry observers note that while clinical results remain the ultimate determinant, AprilBio’s partnered assets being treated as core programs underscores renewed confidence. The company is increasingly seen as benefiting from a technology driven re-rating across immune and inflammatory markets.

|

AprilBio rallied as competitive setbacks in its drug class helped spotlight its licensed technologies currently in global clinical programs.

ToolGen jumps on U.S. EU patent wins

ToolGen climbed 10.5% to won 60,000 after securing consecutive CRISPR-Cas9 RNP intellectual property wins in major jurisdictions. According to KG Zeroin MP Doctor, the company recently obtained a delivery platform patent from the U.S. Patent and Trademark Office followed this month by successful rights defense over plant related RNP IP in Europe.

On December 10, it received an Intention to Grant notice from the European Patent Office regarding a CRISPR RNP patent (EP 4 397 760).

ToolGen’s RNP approach introduces Cas9 protein and guide RNA directly as a complex, minimizing risks of foreign DNA insertion and reducing off target events compared to DNA or mRNA-based delivery. In addition to therapeutic applications the technology is already used in seed and agricultural fields, reinforcing its breadth and commercial relevance.

A key point for investors has been ToolGen‘s success in countering two third party observations filed by Vertex Pharmaceuticals which attempted to weaken ToolGen’s patent position. Having overcome those challenges, ToolGen is now pursuing patent infringement litigation tied to Exa-cel the first globally approved CRISPR therapy. This marks a shift toward proactive enforcement of what it describes as its “rightful business foundation.”

CEO Jong-Sang Yoo emphasized that recognition in both the U.S. and Europe demonstrates differentiation at the technology core. ToolGen‘s CRISPR-Cas9 RNP patent portfolio now spans Korea, the U.S., Europe, Japan, Hong Kong, and Australia, further building competitive barriers in the emerging genome-editing landscape.

|

Kangstem Biotech gained 10.9% to won 2,135 amid progress in hair follicle organoid-based drug screening and anticipation linked to national discussions around reimbursement for hair loss treatments. The company announced a joint research agreement with Institut Pasteur Korea to apply its proprietary follicle organoids in external screening programs for the first time.

Under the collaboration, Kangstem supplies organoids that closely reproduce human follicle biology, while Pasteur Korea establishes an evaluation system using its advanced screening capabilities. This model complements traditional 2D cell assays and animal studies by capturing human-specific efficacy and safety information in early development.

Management noted that the technology could improve the likelihood of clinical success for hair-loss candidates and enable screening services organoid based CRO offerings and target discovery businesses.

With organoids widely seen as a higher value market opportunity versus existing artificial skin or 2D platforms investors view the partnership as a concrete step toward revenue generation and broader industry uptake.

|

AprilBio advanced 12.9% to won 55,100 as its out licensed programs maintained strategic priority in global pipelines while rival assets lost momentum. Its thyroid eye disease (TED) candidate APB-A1, partnered with Lundbeck is in Phase 1b with interim signals supporting a mid 2025 data readout.

Analysts see the project as having achieved early proof-of-concept suggesting potential expansion into autoimmune disorders such as multiple sclerosis and generalized myasthenia gravis.

Meanwhile, EvoMune is progressing APB-R3 a SAFA platform based asset for atopic dermatitis in Phase 2a with data expected in the first quarter of next year. Success would open pathways into inflammatory bowel diseases including ulcerative colitis and Crohn’s disease, simultaneously strengthening commercial validation of the underlying technology.

Investor optimism has been reinforced by market disruption in the FcRn-inhibitor class, once viewed as a primary TED strategy. Immunovant‘s batoclimab has lost priority in pipeline strategy and Argenx recently halted Phase 3 development of its subcutaneous efgartigimod for TED after an IDMC recommendation.

With FcRn competition weakening APB-A1 which targets the CD40L pathway has drawn attention as a differentiated mechanism that may offer a more favorable safety profile and support therapeutic diversification in TED.

|

김지완 2pac@

![2% Royalty Shock at Alteogen Ripples Through Korean Biotech[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012200181b.jpg)

!['2% 로열티'가 무너뜨린 신뢰…알테오젠發 바이오株 동반 하락[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012201091b.jpg)