P Slow Market, Stirred Only by Political Theme Stocks[K-Bio Pulse]

created on 05/01/2025 9:50:12 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 05/01/2025 9:50:12 AM

Subscribe

[Lim Jeong-yeo, Edaily Reporter] South Korean stock marekt’s biopharmaceuticals sector on Wednesday showed lackluster performance, following a string of clinical trial setbacks from Bridge Biotherapeutics and Orum Therapeutics. Stocks appearing to be connected to presidential race candidates showed most surge, while a handful of R&D-driven companies showed gains.

Unexpectedly Tagged as a “Lee Jae-myung Theme Stock”

According to KG Zeroin’s MP Doctor(formerly MarketPoint), shares of OrientBio surged 25%(329won) to close at 1,645won. The company was grouped with so-called “Lee Jae-myung theme stocks” after it became known that the liberal candidate considered as the front-runner in the June 3 presidential election, once worked at an Orient Watch factory in his youth. Buying momentum picked up just a day prior to the Supreme Court ruling on Lee’s ongoing election law case.

The Supreme Court is scheduled to deliver its ruling at 3 p.m. on May 1 in a full bench decision. This comes 36 days after the appellate ruling and 9 days after the Supreme Court formally took up the case following a prosecution appeal. The verdict is expected to significantly impact Lee’s chances in the presidential race.

An OrientBio official commented, “Even if we say we’re not (connected to Lee), the market interprets us that way.”

Overall Weakness in the Biotech Sector

Bridge Biotherapeutics has been on a steady decline since announcing on April 14 that its idiopathic pulmonary fibrosis (IPF) treatment candidate “BBT-877” failed to demonstrate statistical significance in its Phase 2 topline data. Shares fell another 15.9% (170won) to close at 894 won on Wednesday.

Bridge Biotherapeutics’ market cap plummeted from 478.2 billion won, with a share price of 9,280 won on April 14, to 46.6 billion won in just two weeks.

While clinical trial failures are not uncommon in drug development, this case shocked the market as the company had shown promising interim data right up until the final results. James Lee, CEO of Bridge Biotherapeutics, attempted damage control by noting that BBT-877, an autotaxin inhibitor, showed strong safety profile and could be licensed out for other indications.

Orum Therapeutics, another South Korean novel drug developer, recently announced strategic termination of a key pipeline, leading to a drop of 6.27% (1,210won) to close at 18,080 won on Wednesday. The company decided to shut down the program due to a serious adverse event(SAE) that occurred in November, in order to reallocate resources to its next pipeline. The company explained that the toxicity issue was limited to the halted candidate, the market appears to remain wary.

Select KOSDAQ Biotechs Show Strength

Onconic Therapeutics, a subsidiary of Jeil Pharmaceutical, gained 8.04% (1,700won) to close at 22,850won on Wednesday. The company had presented preclinical data for its gastric cancer drug candidate “Nesuparib” at the 2025 American Association for Cancer Research (AACR) Annual Meeting held in Chicago.

According to Onconic, animal models implanted with patient-derived gastric cancer cells showed strong anticancer effects from Nesuparib. In a mouse model using KATOIII cells, which have normal DNA repair function, Nesuparib independently reduced tumor size by 57.2% compared to the control group. When combined with the standard treatment Irinotecan, tumor reduction reached 92.4%.

In a HER2-positive NCI-N87 mouse model, Nesuparib independently achieved a 74% tumor reduction, and in combination with Irinotecan, it reached 99.3% compared to the control.

D&D Pharmatech also rose 9.59% (5,900won) to close at 67,400won, Wednesday, after announcing that its treatment candidate “DD01” for metabolic dysfunction-associated steatohepatitis(MASH) had been granted a U.S. patent. The company is reportedly planning to pursue a license-out deal based on its upcoming Phase 2 primary endpoint data, which further fueled investor interest.

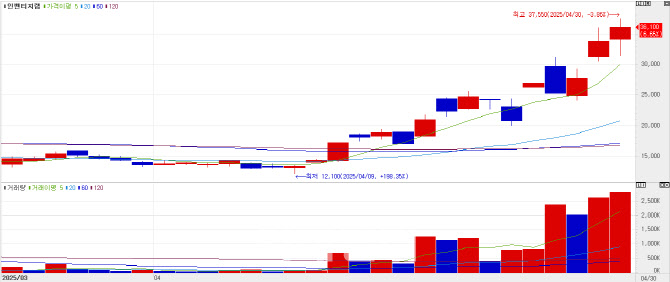

Inventage Lab Gains on Obesity Pill Hype

Inventage Lab saw its shares rise 6.65% (2,250won) to close at 36,100won, after its coverage on PharmEdaily’s premium content, <노보노디스크 뛰어넘었다는 라파스 vs. 인벤티지랩, 누가 유리할까> was made publicly available on portals like Naver on Wednesday.

The article compared Inventage Lab’s swallowable semaglutide obesity drug with Novo Nordisk’s Rybelsus. Rybelsus is an oral semaglutide approved for diabetes treatment. While Rybelsus is approved for once-daily oral administration, its oral bioavailability is known to be just 0.5 to 1%, a major limitation compared to injectable forms.

In contrast, Inventage Lab drew attention by achieving 24.3% bioavailability in animal studies with its once-weekly oral semaglutide formulation. This potential breakthrough helped boost investor enthusiasm.

PharmEdaily had carried out an interview with Kim Ju-hee, CEO of Inventage Lab, which was featured in another recent premium article <김주희 인벤티지랩 대표 “경구화 플랫폼 개발성공…먹는 비만약 무한확장 도전”>.

|

According to KG Zeroin’s MP Doctor(formerly MarketPoint), shares of OrientBio surged 25%(329won) to close at 1,645won. The company was grouped with so-called “Lee Jae-myung theme stocks” after it became known that the liberal candidate considered as the front-runner in the June 3 presidential election, once worked at an Orient Watch factory in his youth. Buying momentum picked up just a day prior to the Supreme Court ruling on Lee’s ongoing election law case.

The Supreme Court is scheduled to deliver its ruling at 3 p.m. on May 1 in a full bench decision. This comes 36 days after the appellate ruling and 9 days after the Supreme Court formally took up the case following a prosecution appeal. The verdict is expected to significantly impact Lee’s chances in the presidential race.

An OrientBio official commented, “Even if we say we’re not (connected to Lee), the market interprets us that way.”

Overall Weakness in the Biotech Sector

Bridge Biotherapeutics has been on a steady decline since announcing on April 14 that its idiopathic pulmonary fibrosis (IPF) treatment candidate “BBT-877” failed to demonstrate statistical significance in its Phase 2 topline data. Shares fell another 15.9% (170won) to close at 894 won on Wednesday.

Bridge Biotherapeutics’ market cap plummeted from 478.2 billion won, with a share price of 9,280 won on April 14, to 46.6 billion won in just two weeks.

While clinical trial failures are not uncommon in drug development, this case shocked the market as the company had shown promising interim data right up until the final results. James Lee, CEO of Bridge Biotherapeutics, attempted damage control by noting that BBT-877, an autotaxin inhibitor, showed strong safety profile and could be licensed out for other indications.

Orum Therapeutics, another South Korean novel drug developer, recently announced strategic termination of a key pipeline, leading to a drop of 6.27% (1,210won) to close at 18,080 won on Wednesday. The company decided to shut down the program due to a serious adverse event(SAE) that occurred in November, in order to reallocate resources to its next pipeline. The company explained that the toxicity issue was limited to the halted candidate, the market appears to remain wary.

|

Onconic Therapeutics, a subsidiary of Jeil Pharmaceutical, gained 8.04% (1,700won) to close at 22,850won on Wednesday. The company had presented preclinical data for its gastric cancer drug candidate “Nesuparib” at the 2025 American Association for Cancer Research (AACR) Annual Meeting held in Chicago.

According to Onconic, animal models implanted with patient-derived gastric cancer cells showed strong anticancer effects from Nesuparib. In a mouse model using KATOIII cells, which have normal DNA repair function, Nesuparib independently reduced tumor size by 57.2% compared to the control group. When combined with the standard treatment Irinotecan, tumor reduction reached 92.4%.

In a HER2-positive NCI-N87 mouse model, Nesuparib independently achieved a 74% tumor reduction, and in combination with Irinotecan, it reached 99.3% compared to the control.

D&D Pharmatech also rose 9.59% (5,900won) to close at 67,400won, Wednesday, after announcing that its treatment candidate “DD01” for metabolic dysfunction-associated steatohepatitis(MASH) had been granted a U.S. patent. The company is reportedly planning to pursue a license-out deal based on its upcoming Phase 2 primary endpoint data, which further fueled investor interest.

Inventage Lab Gains on Obesity Pill Hype

Inventage Lab saw its shares rise 6.65% (2,250won) to close at 36,100won, after its coverage on PharmEdaily’s premium content, <노보노디스크 뛰어넘었다는 라파스 vs. 인벤티지랩, 누가 유리할까> was made publicly available on portals like Naver on Wednesday.

The article compared Inventage Lab’s swallowable semaglutide obesity drug with Novo Nordisk’s Rybelsus. Rybelsus is an oral semaglutide approved for diabetes treatment. While Rybelsus is approved for once-daily oral administration, its oral bioavailability is known to be just 0.5 to 1%, a major limitation compared to injectable forms.

In contrast, Inventage Lab drew attention by achieving 24.3% bioavailability in animal studies with its once-weekly oral semaglutide formulation. This potential breakthrough helped boost investor enthusiasm.

PharmEdaily had carried out an interview with Kim Ju-hee, CEO of Inventage Lab, which was featured in another recent premium article <김주희 인벤티지랩 대표 “경구화 플랫폼 개발성공…먹는 비만약 무한확장 도전”>.

|

임정요 kaylalim@

![i-Sens Soars 23% on EU CGM Expansion [K-bio pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021300327b.jpg)

![냉탕 온탕 오간 에이프릴바이오…실적 호조에 로킷·휴젤 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021200275b.jpg)