Celltrion’s Yuflyma Hits 24% in Europe on Direct Sales Strength

[Kim Saemi, Edaily Reporter] Celltrion’s autoimmune therapy Yuflyma is on the verge of claiming the top prescription spot in Europe.

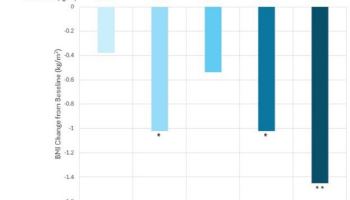

According to pharmaceutical market research firm IQVIA on August 4, Yuflyma posted a 24% market share in Europe in the first quarter of this year, a 3-percentage-point increase from the previous quarter. This leaves just a 1 point gap with the No.1 product placing Yuflyma within striking distance of the European adalimumab (the active ingredient) leadership.

The company highlighted that this is “a significant achievement in a highly competitive market with over 10 adalimumab products, including the original Humira approved by the European Medicines Agency (EMA).”

This performance also demonstrates that Yuflyma has broken the conventional ‘first mover market advantage’ formula. In fact, Yuflyma was a latecomer, entering Europe in the third quarter of 2021, three years after many adalimumab biosimilars first launched in the third quarter of 2018.

Celltrion attributes this success largely to the strength of its European direct-sales network. Yuflyma is the company’s second product in Europe sold directly, following Remsima SC. Leveraging experience from direct sales of the Remsima IV/SC portfolio including tender bidding hospital engagement and stakeholder network management Celltrion actively applied its sales know how to Yuflyma.

The therapy’s overlapping indications with key products also helped drive uptake, as Celltrion could fully utilize its pre established physician network. The company targeted the switching segment, where some autoimmune patients develop tolerance to long term single agent therapy and require a product change. By adding an adalimumab option to its already dominant infliximab portfolio Celltrion created cross therapy synergies that support prescription switching.

As a result, Yuflyma is showing clear momentum across Europe. In Italy one of the EU5 markets it reached a 52% share up 5 points QoQ surpassing half of all prescriptions. The UK also rose 5 points to 33%, while Finland posted 47%. In Portugal and the Netherlands, Yuflyma achieved 21% and 20% shares, respectively, validating its competitive strength.

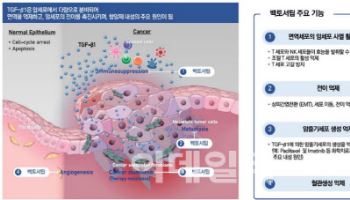

Looking ahead, Celltrion plans to sustain Yuflyma’s European growth by expanding its autoimmune portfolio. After launching Steqima late last year, the company is preparing to introduce Aptozma in the second half of this year. Once launched, Celltrion will hold five first-line autoimmune therapies in Europe, enabling broader physician and patient coverage, enhanced switching options for tolerant patients, and deeper leverage of its product experience and know how.

A Celltrion official said, “The fact that Yuflyma joined the top prescription tier despite launching three years later than competitors demonstrates that our direct sales capability delivers competitiveness beyond first-mover advantage. With new product launches by year end further strengthening our portfolio we will actively leverage cross-product synergies to expand sales across the lineup.”

|

The company highlighted that this is “a significant achievement in a highly competitive market with over 10 adalimumab products, including the original Humira approved by the European Medicines Agency (EMA).”

This performance also demonstrates that Yuflyma has broken the conventional ‘first mover market advantage’ formula. In fact, Yuflyma was a latecomer, entering Europe in the third quarter of 2021, three years after many adalimumab biosimilars first launched in the third quarter of 2018.

Celltrion attributes this success largely to the strength of its European direct-sales network. Yuflyma is the company’s second product in Europe sold directly, following Remsima SC. Leveraging experience from direct sales of the Remsima IV/SC portfolio including tender bidding hospital engagement and stakeholder network management Celltrion actively applied its sales know how to Yuflyma.

The therapy’s overlapping indications with key products also helped drive uptake, as Celltrion could fully utilize its pre established physician network. The company targeted the switching segment, where some autoimmune patients develop tolerance to long term single agent therapy and require a product change. By adding an adalimumab option to its already dominant infliximab portfolio Celltrion created cross therapy synergies that support prescription switching.

As a result, Yuflyma is showing clear momentum across Europe. In Italy one of the EU5 markets it reached a 52% share up 5 points QoQ surpassing half of all prescriptions. The UK also rose 5 points to 33%, while Finland posted 47%. In Portugal and the Netherlands, Yuflyma achieved 21% and 20% shares, respectively, validating its competitive strength.

Looking ahead, Celltrion plans to sustain Yuflyma’s European growth by expanding its autoimmune portfolio. After launching Steqima late last year, the company is preparing to introduce Aptozma in the second half of this year. Once launched, Celltrion will hold five first-line autoimmune therapies in Europe, enabling broader physician and patient coverage, enhanced switching options for tolerant patients, and deeper leverage of its product experience and know how.

A Celltrion official said, “The fact that Yuflyma joined the top prescription tier despite launching three years later than competitors demonstrates that our direct sales capability delivers competitiveness beyond first-mover advantage. With new product launches by year end further strengthening our portfolio we will actively leverage cross-product synergies to expand sales across the lineup.”

김새미 bird@

![황만순 한국투자파트너스 대표 “단점에 솔직하지 못한 기업 피해라”[바이오 VC 집중조명]⑤](https://image.edaily.co.kr/images/vision/files/NP/S/2025/08/PS25080300031b.jpg)