EnsolBio Plunges on Phase 3 Failure…Curiox Jumps on BEP Hopes[K-Bio Pulse]

created on 08/05/2025 8:30:00 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 08/05/2025 8:30:00 AM

Subscribe

[NA Eun-kyung, Edaily Reporter] On Aug 4 the domestic pharmaceutical biotech and healthcare market saw sharp declines for EnsolBioScience and T&R Biofab following the news of a failed Phase 3 clinical trial and a massive equity offering exceeding half of their market capitalization.

In contrast Curiox Biosystems surged with double digit gains as investors bet on a second half revenue boost to achieve break even (BEP).

Placebo Response Overshadows Phase 3

According to KG Zeroin MP Doctor (formerly MarketPoint), U.S. partner Spine BioPharma announced on Aug. 2 (local time Aug. 1) that P2K, a degenerative disc treatment licensed from KONEX listed EnsolBioScience and codeveloped with Yuhan Corp, failed to meet its primary endpoint in Phase 3 trials.

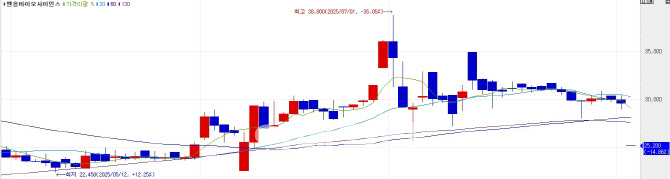

EnsolBio shares hit the KONEX daily lower limit of 15%, closing at 25,200 won, down 14.86% from the previous session’s 29,600 won.

P2K also known as YH14618 under Yuhan’s development name, is EnsolBio’s flagship pipeline targeting non-surgical treatment of degenerative disc disease with potential as a breakthrough therapy. Initially licensed out to Yuhan in 2009, the project later transferred exclusive commercialization rights to Spine BioPharma in 2018, which conducted the Phase 3 trial.

Shares had soared to 38,800 won earlier this year from the upper 10,000-won range, fueled by optimism about the trial. Comments from Smart & Growth CEO Hyung In woo EnsolBio’s largest shareholder in early July also lifted sentiment stating that “everything in P2K’s clinical progress is smooth and response rates remain excellent.”

However the placebo group’s unexpectedly high response rate caused the trial to miss statistical significance on its primary endpoints the Oswestry Disability Index (ODI) plus Numerical Rating Scale (NRS) for pain.

Yuhan Corp., which conducted the Phase 2 trial in Korea, slipped only 0.09%, as it had already sold its EnsolBio stake to Hyung ahead of the Phase 3 readout.

EnsolBio has secured a $4 million milestone payment (about 5.5 billion won) upon receiving the clinical study report (CSR), regardless of the outcome. But royalties from overseas commercialization and a 3% royalty on potential domestic sales may be delayed or lost. The company previously expected up to 200 billion won in revenue from P2K alone upon commercialization.

EnsolBio said it does not face immediate liquidity issues. It raised 20.4 billion won in a third-party placement on July 10 from Hyung and another 2 billion won from Capstone Scale-up Fund on July 22, securing 22.4 billion won last month alone.

“The runway cannot be disclosed, but with recent funding we have no immediate financial problem,” a company official said. “Most of the capital will go to the Phase 3 trial of osteoarthritis candidate E1K, with the remainder for operations. We are fully prepared to pursue a KOSDAQ transfer listing as soon as any visible success emerges from our innovative pipelines.”

Curiox Rallies as Market Bets on Growth

Curiox jumped 10.23% without any specific corporate announcement, drawing market attention.

“There is no particular news we’ve disclosed to the market” a company official told Edaily. “We are currently negotiating sales of our new products launched in the second half of last year with global conglomerates, and the market likely reflects expectations for stronger second half earnings.”

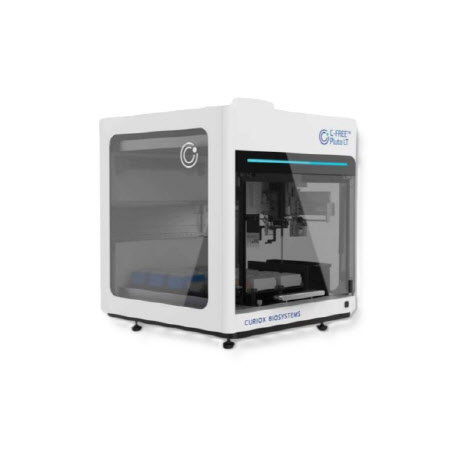

Curiox develops automated sample preparation devices that are essential in cell-based drug development and diagnostics. Manual preparation is still common but automation improves consistency. The company says it is the only developer of such devices.

In April PharmEdaily reported CEO Kim Nam yong’s comments that “Pluto Series products are gaining traction and we are in final talks with top 10 U.S. bio equipment companies,” adding that the firm could reach break even this year.

Curiox estimates peak sales from this segment at 5.7 trillion to 9.5 trillion won. “The global market for manual centrifuge-based cell analysis is estimated at 19 trillion won” the official said. “Our long-term goal is to capture at least 30% and up to 50% of that market.”

T&R Biofab Slumps on Dilution Fears

T&R Biofab plunged 21.44%, the steepest drop among pharma and healthcare stocks, after announcing a 40 billion won rights issue after the market closed on Aug. 1.

The issuance equals roughly 61% of its 65.9 billion won market cap as of Aug. 4, and 56% of the proceeds, or 22.4 billion won, will be used for debt repayment. The large-scale issuance raised concerns over shareholder dilution.

The company’s debt ratio stood at 395% in the first quarter, with 29 billion won in convertible bonds facing potential near-term repayment requests. It said it repaid 6.6 billion won of CBs on Aug 4.

Revenue growth offers a bright spot. T&R Biofab posted 6.5 billion won in second-quarter sales, up 376% from a year earlier. Cumulative first half revenue reached 12.4 billion won, up 388% year on year.

“We decided on the rights issue, including a 20% bonus issue, to eliminate market concerns about financial risk and fundamentally improve future performance,” CEO Yoon Won soo said. “We aim to use this as a springboard for growth, with successive K-beauty supply deals expected to drive a revenue surge. We will deliver results that meet shareholder expectations.”

In contrast Curiox Biosystems surged with double digit gains as investors bet on a second half revenue boost to achieve break even (BEP).

|

According to KG Zeroin MP Doctor (formerly MarketPoint), U.S. partner Spine BioPharma announced on Aug. 2 (local time Aug. 1) that P2K, a degenerative disc treatment licensed from KONEX listed EnsolBioScience and codeveloped with Yuhan Corp, failed to meet its primary endpoint in Phase 3 trials.

EnsolBio shares hit the KONEX daily lower limit of 15%, closing at 25,200 won, down 14.86% from the previous session’s 29,600 won.

P2K also known as YH14618 under Yuhan’s development name, is EnsolBio’s flagship pipeline targeting non-surgical treatment of degenerative disc disease with potential as a breakthrough therapy. Initially licensed out to Yuhan in 2009, the project later transferred exclusive commercialization rights to Spine BioPharma in 2018, which conducted the Phase 3 trial.

Shares had soared to 38,800 won earlier this year from the upper 10,000-won range, fueled by optimism about the trial. Comments from Smart & Growth CEO Hyung In woo EnsolBio’s largest shareholder in early July also lifted sentiment stating that “everything in P2K’s clinical progress is smooth and response rates remain excellent.”

However the placebo group’s unexpectedly high response rate caused the trial to miss statistical significance on its primary endpoints the Oswestry Disability Index (ODI) plus Numerical Rating Scale (NRS) for pain.

Yuhan Corp., which conducted the Phase 2 trial in Korea, slipped only 0.09%, as it had already sold its EnsolBio stake to Hyung ahead of the Phase 3 readout.

EnsolBio has secured a $4 million milestone payment (about 5.5 billion won) upon receiving the clinical study report (CSR), regardless of the outcome. But royalties from overseas commercialization and a 3% royalty on potential domestic sales may be delayed or lost. The company previously expected up to 200 billion won in revenue from P2K alone upon commercialization.

EnsolBio said it does not face immediate liquidity issues. It raised 20.4 billion won in a third-party placement on July 10 from Hyung and another 2 billion won from Capstone Scale-up Fund on July 22, securing 22.4 billion won last month alone.

“The runway cannot be disclosed, but with recent funding we have no immediate financial problem,” a company official said. “Most of the capital will go to the Phase 3 trial of osteoarthritis candidate E1K, with the remainder for operations. We are fully prepared to pursue a KOSDAQ transfer listing as soon as any visible success emerges from our innovative pipelines.”

|

Curiox jumped 10.23% without any specific corporate announcement, drawing market attention.

“There is no particular news we’ve disclosed to the market” a company official told Edaily. “We are currently negotiating sales of our new products launched in the second half of last year with global conglomerates, and the market likely reflects expectations for stronger second half earnings.”

Curiox develops automated sample preparation devices that are essential in cell-based drug development and diagnostics. Manual preparation is still common but automation improves consistency. The company says it is the only developer of such devices.

In April PharmEdaily reported CEO Kim Nam yong’s comments that “Pluto Series products are gaining traction and we are in final talks with top 10 U.S. bio equipment companies,” adding that the firm could reach break even this year.

Curiox estimates peak sales from this segment at 5.7 trillion to 9.5 trillion won. “The global market for manual centrifuge-based cell analysis is estimated at 19 trillion won” the official said. “Our long-term goal is to capture at least 30% and up to 50% of that market.”

T&R Biofab Slumps on Dilution Fears

T&R Biofab plunged 21.44%, the steepest drop among pharma and healthcare stocks, after announcing a 40 billion won rights issue after the market closed on Aug. 1.

The issuance equals roughly 61% of its 65.9 billion won market cap as of Aug. 4, and 56% of the proceeds, or 22.4 billion won, will be used for debt repayment. The large-scale issuance raised concerns over shareholder dilution.

The company’s debt ratio stood at 395% in the first quarter, with 29 billion won in convertible bonds facing potential near-term repayment requests. It said it repaid 6.6 billion won of CBs on Aug 4.

Revenue growth offers a bright spot. T&R Biofab posted 6.5 billion won in second-quarter sales, up 376% from a year earlier. Cumulative first half revenue reached 12.4 billion won, up 388% year on year.

“We decided on the rights issue, including a 20% bonus issue, to eliminate market concerns about financial risk and fundamentally improve future performance,” CEO Yoon Won soo said. “We aim to use this as a springboard for growth, with successive K-beauty supply deals expected to drive a revenue surge. We will deliver results that meet shareholder expectations.”

나은경 eeee@

![EnsolBio Plunges on Phase 3 Failure…Curiox Jumps on BEP Hopes[K-Bio Pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/08/PS25080500376b.jpg)

![‘믿었던 3상 실패’ 엔솔바이오↓… ‘BEP 노리는’ 큐리옥스↑[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/08/PS25080500379b.jpg)