Private Equity Funds Choking K-Bio

|

Medical aesthetics devices are, in many ways, not so different from IT hardware. And as Korea has already established itself as a powerhouse in IT, this sector has seen the emergence of globally competitive companies one after another. The worldwide craze for K-beauty is adding strong momentum, making now arguably the most favorable time in history for Korea’s medical aesthetics industry to expand.

Looking at leading K-aesthetic device companies, many are recording hyper-growth of around 50% annually in sales while operating profit margins often reach 50~60%, the highest across all industries. Backed by advanced product technology and, most importantly, proven effectiveness in skincare, these devices are enjoying soaring demand not only at home but across global markets.

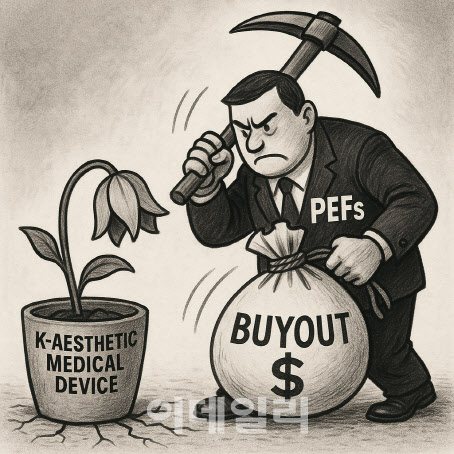

As more K-aesthetic firms achieve exponential growth, the capital market has taken notice, eager to secure preemptive stakes. Private equity funds (PEFs), which have been expanding aggressively across all industries, are at the forefront of this rush.

Already, industry leaders such as Hugel, Classys, Lutronic, Jeysis Medical, and VIOL have been absorbed into the hands of PEFs. Beyond these acquisitions, PEFs are now actively courting the few remaining high-growth firms in the sector, suggesting the list of buyouts will grow even longer. At this rate, most globally competitive Korean medical aesthetics companies may soon be under PEF control.

Selling a company to PEFs for astronomical sums after scaling its value is a common business practice not only in Korea but also in advanced markets like the U.S. There is no inherent problem with that. But the story is different for an industry like Korean medical aesthetics, which is just on the verge of emerging as a true global player.

|

What makes this more concerning is that more than half of the PEFs acquiring Korean aesthetic firms are foreign-owned. This means the core competitive edge of the industry is effectively being transferred overseas. If the current trend continues, the K-aesthetic device industry may wither before it has a chance to fully bloom in the global market.

It is well known that PEFs, while there are exceptions, rarely focus on long-term R&D investment. Instead, their primary goal is short-term profit-taking. Typically, firms acquired by PEFs are delisted, stripped for profit, and eventually resold. In short, many PEFs are less concerned with building future competitiveness than with extracting immediate gains and discarding the rest.

In conclusion, while the marriage between K-aesthetic medical devices and PEFs may look like a gold mine for the funds, it could prove the worst possible outcome for the Korean industry. In the face of the growing difficulty of securing new growth engines for South Korea’s aging economy, there is hope that the K-aesthetic medical device industry, one of the few emerging sectors discovered, will not stumble midway but instead rise to become a true global player.

![[옥석 가리는 AI의료]김영웅 디지털헬스산업협회장 "AI의료 옥석가리기 시대, 역량 강화가 생존 열...](https://image.edaily.co.kr/images/vision/files/NP/S/2025/09/PS25091700181b.jpg)

![[옥석 가리는 AI의료]루닛 이후 2세대 기업도 1조 클럽 가능…뜨는 다크호스는](https://image.edaily.co.kr/images/vision/files/NP/S/2025/09/PS25091700167b.jpg)