[K-Bio Pulse] Humedix, Caregen Rally on Robust Export Momentum

created on 07/23/2025 9:30:45 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 07/23/2025 9:30:45 AM

Subscribe

[Seungkwon kim, Edaily Reporter] Shares of Humedix soared Tuesday amid growing expectations for overseas sales, while Caregen also closed sharply higher following positive feedback at a global exhibition. The gains stood out among domestic pharmaceutical, biotech, and healthcare stocks with promising export prospects. Seers Technology also posted modest gains on revenue growth expectations.

Humedix Hits 52-Week High on Filler Export Boom and Global Expansion

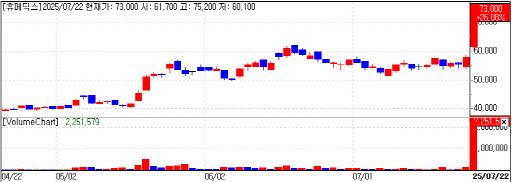

According to KG Zeroin‘s MPDOCTOR platform, Humedix surged to a 52-week high of 75,200 won on the KOSDAQ before closing at 73,000 won, up 26% from the previous session. The stock spiked from the opening bell.

Shares of parent company Huons Global rose around 6-7% alongside Humedix, reflecting broader optimism for Botox and filler-related stocks like Medytox and Hugel amid expectations for export growth.

Founded in 2003 as HanYakMaeul and rebranded in 2010, Humedix specializes in hyaluronic acid (HA) and polydeoxyribonucleotide (PDRN) products, including dermal fillers, arthritis treatments, and eye drops. The company also leads the domestic market for heparin sodium active pharmaceutical ingredients.

Humedix’s filler business has shown remarkable growth, with exports soaring 39.8% year-over-year to 35.5 billion won in 2024. The trend over the past three years?16.3 billion won in 2022, 25.4 billion won in 2023, and an estimated 37 billion won in 2024?underscores robust expansion.

The Brazilian market has been a standout. Humedix‘s filler exports to Brazil jumped from 8 billion won in 2023 to 17 billion won this year, with plans to launch a body filler in the second half after regulatory approval. According to SangSangin Investment & Securities, Brazil-bound filler exports may rise to around 25 billion won this year.

Currently exporting to 19 countries including China and Brazil, Humedix is also accelerating its push into Southeast Asia. The company secured approvals from Thailand’s FDA for three HA filler products, with Elravie and Revolline set to launch in the second quarter. Expansion into Vietnam is also underway.

Investor sentiment was further buoyed by expectations for regulatory approval of its next-generation filler Belfien. “The clinical trial for Belfien is expected to wrap up in the first half of this year, with a regulatory filing likely by year-end. If all goes well, commercialization could begin in the latter half of next year,” said Ha Tae-ki, analyst at SangSangin Investment & Securities.

Belfien, a combination filler made of hyaluronic acid and polynucleotide, is designed for temporary improvement of fine lines around the eyes. It is the first PN combination filler developed by Humedix and has already secured export approval.

“While Humedix‘s forward P/E ratio of 14.2 isn’t particularly cheap, its strong filler export growth and multiple catalysts warrant a long-term investment view,” Ha noted.

Despite intensifying competition in the domestic filler market, dominated by Hugel, LG Life Sciences, Humedix, Medytox, and PharmaResearch, the global filler market remains a high-potential blue ocean. Vantage Market Research projects the global filler market will reach 12.4 trillion won by 2030.

A biotech industry insider commented, “Humedix’s sharp stock rally reflects both its growth potential in the global filler market and its new product pipeline. The company’s performance in Brazil and the progress of Belfien’s clinical trial are drawing keen investor interest, making its growth strategy and earnings trajectory worth watching.”

Caregen, Seers Technology Gain on Expansion Hopes

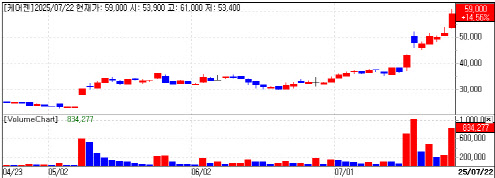

Caregen shares also rallied, closing up 15% at 59,000 won, extending their gains above the 5-day moving average.

The rally follows Caregen’s unveiling of its core technologies at CPHI Worldwide 2025 in Barcelona, one of the world’s largest pharma exhibitions attended by some 40,000 industry participants. The company reportedly drew strong interest from global buyers.

Caregen showcased functional peptides for skin and hair, along with anti-aging, lipid control, and anti-inflammatory applications. Its proprietary smart peptide delivery technology attracted particular attention. The company boasts a portfolio of over 800 proprietary peptides and more than 200 international patents. Caregen also highlighted its large-scale production and quality control capabilities at the event.

“We held detailed talks with major pharmaceutical companies from Europe, the Middle East, and Asia and made significant headway in CDMO and licensing discussions,” a company official said.

Though less known domestically, Caregen exports to more than 130 countries and has built a stable revenue base through partnerships with global leaders in medical aesthetics and functional cosmetics.

Industry watchers see peptides as an emerging key ingredient in next-generation biologics. “Caregen’s advanced peptide technologies enhance its potential for partnerships with global big pharma,” one expert said.

Building on its CPHI success, Caregen plans to ramp up efforts in South America and Eastern Europe while accelerating development of new peptide-based pharmaceuticals.

Seers Technology Sees Modest Gains on IoMT Growth

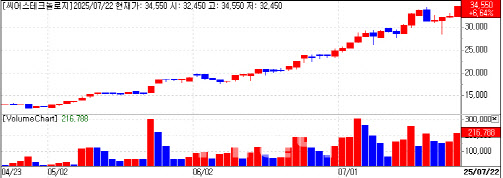

Seers Technology shares edged up 7% to close at 34,550 won, continuing their steady climb. The stock has benefited from strong growth in inpatient monitoring solutions.

The company develops Internet of Medical Things (IoMT) platforms that integrate biosignal analysis, AI algorithms, and wearable devices. Its offerings include mobiCARE™ for diagnostics and health screenings and thynC™ for inpatient monitoring.

Revenue growth is mainly driven by thynC™, with first-quarter sales jumping 445.4% year-over-year to 4.1 billion won.

Second-quarter sales are projected at 6.1 billion won, up 585.3% from a year earlier. “We’ll be watching closely how inpatient solution sales continue to grow,” said analyst Ha Tae-ki.

Humedix Hits 52-Week High on Filler Export Boom and Global Expansion

According to KG Zeroin‘s MPDOCTOR platform, Humedix surged to a 52-week high of 75,200 won on the KOSDAQ before closing at 73,000 won, up 26% from the previous session. The stock spiked from the opening bell.

Shares of parent company Huons Global rose around 6-7% alongside Humedix, reflecting broader optimism for Botox and filler-related stocks like Medytox and Hugel amid expectations for export growth.

Founded in 2003 as HanYakMaeul and rebranded in 2010, Humedix specializes in hyaluronic acid (HA) and polydeoxyribonucleotide (PDRN) products, including dermal fillers, arthritis treatments, and eye drops. The company also leads the domestic market for heparin sodium active pharmaceutical ingredients.

Humedix’s filler business has shown remarkable growth, with exports soaring 39.8% year-over-year to 35.5 billion won in 2024. The trend over the past three years?16.3 billion won in 2022, 25.4 billion won in 2023, and an estimated 37 billion won in 2024?underscores robust expansion.

The Brazilian market has been a standout. Humedix‘s filler exports to Brazil jumped from 8 billion won in 2023 to 17 billion won this year, with plans to launch a body filler in the second half after regulatory approval. According to SangSangin Investment & Securities, Brazil-bound filler exports may rise to around 25 billion won this year.

|

Investor sentiment was further buoyed by expectations for regulatory approval of its next-generation filler Belfien. “The clinical trial for Belfien is expected to wrap up in the first half of this year, with a regulatory filing likely by year-end. If all goes well, commercialization could begin in the latter half of next year,” said Ha Tae-ki, analyst at SangSangin Investment & Securities.

Belfien, a combination filler made of hyaluronic acid and polynucleotide, is designed for temporary improvement of fine lines around the eyes. It is the first PN combination filler developed by Humedix and has already secured export approval.

“While Humedix‘s forward P/E ratio of 14.2 isn’t particularly cheap, its strong filler export growth and multiple catalysts warrant a long-term investment view,” Ha noted.

Despite intensifying competition in the domestic filler market, dominated by Hugel, LG Life Sciences, Humedix, Medytox, and PharmaResearch, the global filler market remains a high-potential blue ocean. Vantage Market Research projects the global filler market will reach 12.4 trillion won by 2030.

A biotech industry insider commented, “Humedix’s sharp stock rally reflects both its growth potential in the global filler market and its new product pipeline. The company’s performance in Brazil and the progress of Belfien’s clinical trial are drawing keen investor interest, making its growth strategy and earnings trajectory worth watching.”

Caregen, Seers Technology Gain on Expansion Hopes

Caregen shares also rallied, closing up 15% at 59,000 won, extending their gains above the 5-day moving average.

The rally follows Caregen’s unveiling of its core technologies at CPHI Worldwide 2025 in Barcelona, one of the world’s largest pharma exhibitions attended by some 40,000 industry participants. The company reportedly drew strong interest from global buyers.

Caregen showcased functional peptides for skin and hair, along with anti-aging, lipid control, and anti-inflammatory applications. Its proprietary smart peptide delivery technology attracted particular attention. The company boasts a portfolio of over 800 proprietary peptides and more than 200 international patents. Caregen also highlighted its large-scale production and quality control capabilities at the event.

|

Though less known domestically, Caregen exports to more than 130 countries and has built a stable revenue base through partnerships with global leaders in medical aesthetics and functional cosmetics.

Industry watchers see peptides as an emerging key ingredient in next-generation biologics. “Caregen’s advanced peptide technologies enhance its potential for partnerships with global big pharma,” one expert said.

Building on its CPHI success, Caregen plans to ramp up efforts in South America and Eastern Europe while accelerating development of new peptide-based pharmaceuticals.

Seers Technology Sees Modest Gains on IoMT Growth

Seers Technology shares edged up 7% to close at 34,550 won, continuing their steady climb. The stock has benefited from strong growth in inpatient monitoring solutions.

|

Revenue growth is mainly driven by thynC™, with first-quarter sales jumping 445.4% year-over-year to 4.1 billion won.

Second-quarter sales are projected at 6.1 billion won, up 585.3% from a year earlier. “We’ll be watching closely how inpatient solution sales continue to grow,” said analyst Ha Tae-ki.

김승권 peace@

![넥스트바이오메디컬, 목표가 '8만원대' 리포트에 급등[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/07/PS25072400334b.jpg)