P SCM Rises, KainosMed Falls as Capital Paths Split[K-bio Pulse]

created on 07/29/2025 9:50:58 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 07/29/2025 9:50:58 AM

Subscribe

[Seok Ji-hoen, Edaily reporter] Shares of KainosMed plunged more than 7% after the company again postponed a scheduled capital injection, raising concerns about its credibility. Hanmi Science also lost over 7% despite strong second-quarter earnings, amid continued concerns over governance risks. Meanwhile, SCM Lifescience jumped over 12% after completing a third-party allotment capital increase, boosting investor sentiment.

Capital Injection Delay Hits KainosMed

According to MP Doctor (formerly MarketPoint) under KG Zeroin, KainosMed shares closed at 1,012 won, down 7.24% from the previous session. The drop followed the company’s announcement on July 25 that it would delay the payment date for a 16.7 billion won capital increase to Nov. 14. This marks the eighth revision since the original deadline of Dec. 30, 2024, involving Chiron Global Group and other individual investors.

Under KOSDAQ rules, if a capital increase payment deadline is pushed back more than six months from the original announcement, the company may be designated as a “non-compliant filer” and face penalties of up to 15 points. Companies with more than 15 points face a delisting review. KainosMed has accumulated 5.5 points so far. While it’s unlikely to face immediate delisting, repeated revisions heighten long-term risk.

PharmEdaily previously reported on July 9 that KainosMed was under review by the Korea Exchange for a non-compliance designation. On July 24, the exchange’s KOSDAQ division formally announced a warning against the company for delaying the capital increase.

KainosMed said the delays stemmed from political instability but emphasized it is working with investors to finalize the process. The company denied any plans to cancel the capital increase.

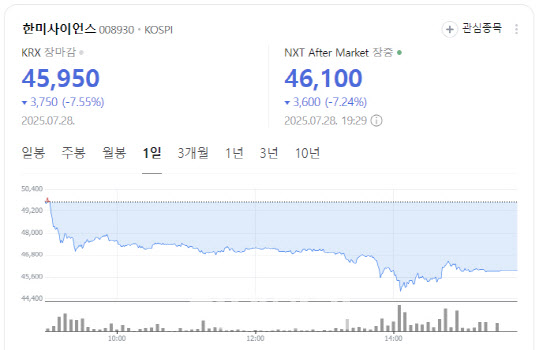

Hanmi Science Drops Despite Strong Earnings

Shares of Hanmi Science, the holding company of the Hanmi Group, also fell 7.55% to 45,950 won. The decline came despite the company posting solid earnings for the second quarter, with revenue of 338.3 billion won, operating profit of 34.6 billion won, and net profit of 28.3 billion won up 9.4%, 30.7%, and 39.2%, respectively, from the year-ago period.

Hanmi Pharmaceutical, a key affiliate, posted quarterly revenue of 361.3 billion won, down 4.5% year over year, though its operating profit rose 4% to 60.4 billion won. Net income fell 8.6% to 43 billion won. Despite margin improvement, the company failed to lift investor sentiment.

Observers attribute the decline to renewed internal strife. Although Hanmi appeared to resolve a yearlong management dispute in March by naming former Meritz Securities executive Jae-Kyo Kim as CEO, tensions resurfaced. Sources say Dong-Guk Shin, Hanmi’s largest shareholder and a non-executive director, has been exerting influence through Bae In-Kyu, an adviser reportedly issuing directives to reduce R&D spending and cut staff. The company has yet to respond publicly to the allegations.

A Hanmi Science spokesperson downplayed the stock decline, saying it was in line with overall market trends.

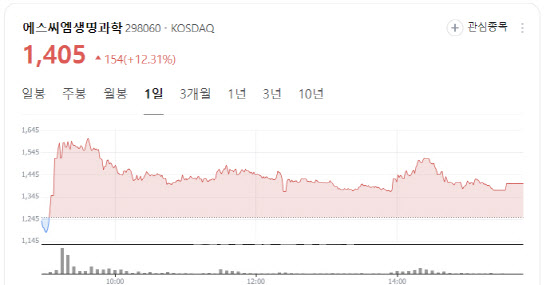

SCM Lifescience Surges on Funding Completion

SCM Lifescience saw its stock jump 12.31% to 1,405 won following the successful completion of a third-party allocation capital increase. The company announced on July 25 that it raised nearly 5 billion won through the issuance of 6.71 million common shares. The new investors, Utah Technology Investment Association No. 82 and Koni Technology Investment Association No. 63, will be under a one-year lock-up.

The move comes as SCM faces financial challenges. The company was designated as a “watchlist” firm in March after incurring pre-tax operating losses that exceeded 50% of its equity in two of the past three fiscal years. The capital injection is expected to stabilize operations and support long-term strategic initiatives.

PharmEdaily first reported in March that SCM’s largest shareholder was seeking to sell its stake, raising further uncertainty about the company’s future.

Capital Injection Delay Hits KainosMed

According to MP Doctor (formerly MarketPoint) under KG Zeroin, KainosMed shares closed at 1,012 won, down 7.24% from the previous session. The drop followed the company’s announcement on July 25 that it would delay the payment date for a 16.7 billion won capital increase to Nov. 14. This marks the eighth revision since the original deadline of Dec. 30, 2024, involving Chiron Global Group and other individual investors.

|

PharmEdaily previously reported on July 9 that KainosMed was under review by the Korea Exchange for a non-compliance designation. On July 24, the exchange’s KOSDAQ division formally announced a warning against the company for delaying the capital increase.

KainosMed said the delays stemmed from political instability but emphasized it is working with investors to finalize the process. The company denied any plans to cancel the capital increase.

Hanmi Science Drops Despite Strong Earnings

Shares of Hanmi Science, the holding company of the Hanmi Group, also fell 7.55% to 45,950 won. The decline came despite the company posting solid earnings for the second quarter, with revenue of 338.3 billion won, operating profit of 34.6 billion won, and net profit of 28.3 billion won up 9.4%, 30.7%, and 39.2%, respectively, from the year-ago period.

|

Observers attribute the decline to renewed internal strife. Although Hanmi appeared to resolve a yearlong management dispute in March by naming former Meritz Securities executive Jae-Kyo Kim as CEO, tensions resurfaced. Sources say Dong-Guk Shin, Hanmi’s largest shareholder and a non-executive director, has been exerting influence through Bae In-Kyu, an adviser reportedly issuing directives to reduce R&D spending and cut staff. The company has yet to respond publicly to the allegations.

A Hanmi Science spokesperson downplayed the stock decline, saying it was in line with overall market trends.

SCM Lifescience Surges on Funding Completion

SCM Lifescience saw its stock jump 12.31% to 1,405 won following the successful completion of a third-party allocation capital increase. The company announced on July 25 that it raised nearly 5 billion won through the issuance of 6.71 million common shares. The new investors, Utah Technology Investment Association No. 82 and Koni Technology Investment Association No. 63, will be under a one-year lock-up.

|

PharmEdaily first reported in March that SCM’s largest shareholder was seeking to sell its stake, raising further uncertainty about the company’s future.

석지헌 cake@

![i-Sens Soars 23% on EU CGM Expansion [K-bio pulse]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021300327b.jpg)

![양동원 서울성모병원 부원장 “레켐비·슈퍼브레인 병용, 치매 진행 지연 효과”[전문가 인사이트]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021700064b.jpg)

![냉탕 온탕 오간 에이프릴바이오…실적 호조에 로킷·휴젤 상승[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021200275b.jpg)