[Seok Ji-hoen, Edaily Reporter] On the 24th, the South Korean pharmaceutical and biotech stock market saw a significant rise in vaccine-related stocks following reports that a new corona virus had been discovered in Wuhan, China. However, as the new virus has only been confirmed in a laboratory setting and the Korea Disease Control and Prevention Agency (KDCA) emphasized that the risk of human infection and transmission should not be exaggerated and the likelihood of another pandemic appears low. Meanwhile, HLB, which is making a second attempt to secure FDA approval for its liver cancer treatment “Rivoceranib,” saw its stock rise by more than 7% that day.

Authorities Move Quickly to Address Concerns

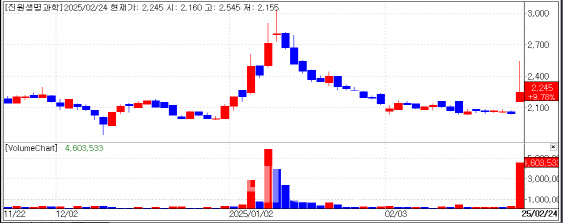

According to MP Doctor (formerly “Market Point”), the stock price of Geneone Life Science closed at 2,245 KRW, up 9.78% from the previous trading day. Genexine was involved in COVID-19 vaccine development during the pandemic.

On February 23, the South China Morning Post (SCMP) reported that a Chinese research team had discovered a new bat coronavirus (HKU5-CoV-2) in a Wuhan laboratory that has the potential to infect humans.

The newly discovered virus belongs to the Merbecovirus group, which includes the virus responsible for Middle East Respiratory Syndrome (MERS). While it shares similarities with the common cold virus (NL63), it exhibits a stronger ability to infect human cells compared to other coronaviruses. However, researchers explained that it does not easily penetrate human cells compared to the COVID-19 virus that spread globally in 2020. Notably, this virus was not detected in humans but was isolated in a laboratory setting.

The study was published on February 18 in the prestigious scientific journal Cell. It was conducted by renowned bat virus expert Dr. Shi Zhengli, also known as “Batwoman,” in collaboration with researchers from the Guangzhou Institute of Science, Wuhan University, and the Wuhan Institute of Virology. Despite concerns, the researchers clarified that the virus “does not easily invade human cells like COVID-19” and “was identified in a laboratory, not in humans.”

The KDCA also urged the public not to overinterpret the findings. During a briefing, the agency stated, “This study was conducted using cell cultures in a laboratory setting, and there is currently insufficient circumstantial evidence to suggest human infection. Therefore, it is important to avoid exaggeration.”

Kim Eun-jin, head of the KDCA’s Novel Pathogen Analysis Division, acknowledged that “while we cannot completely rule out the possibility of human infection, the study found that the virus’s ability to bind to human receptors is significantly weaker compared to MERS or COVID-19. Therefore, the likelihood of immediate human transmission is low.”

As a result, most vaccine and diagnostic kit stocks that had surged in early trading saw their gains diminish. Genexine‘s stock price initially rose by 24%, but some of those gains were later reversed. Other companies that saw gains included Cellid (+4.39%), SK Bioscience (+0.10%), Sugentech (+10.69%), and Medicox (+29.63%), which previously developed a COVID-19 treatment through its subsidiary.

Most of these stocks closed with reduced gains, except for Medicox, which hit the daily price limit. The company had previously announced plans to develop a COVID-19 treatment through its subsidiary, Mecox CureMed, but it remains unclear whether development is still ongoing. Investors are advised to exercise caution, as the company’s business report does not mention any ongoing COVID-19 treatment development. Instead, Medicox primarily operates in the manufacturing sector, producing large ship blocks.

Meanwhile, companies affected by this news appeared indifferent. A Genexine representative stated, “There is no specific company stance on today’s stock price increase. It seems to be influenced by reports of the new coronavirus in China, but we cannot predict what will happen tomorrow.” Similarly, a Sugentech representative stated, “The company has not made any announcements or released any positive news related to today’s stock price increase.”

Is the ‘Big Day’ Approaching?

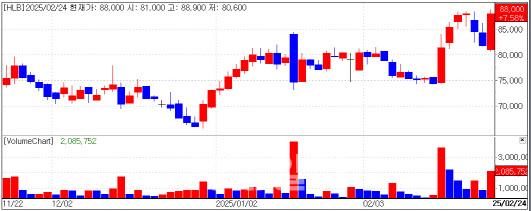

On the same day, HLB’s stock price rose 7.58% to close at 88,000 KRW, driven by market expectations ahead of the FDA’s upcoming decision on the liver cancer treatment ’Rivoceranib‘.

The Prescription Drug User Fee Act (PDUFA) deadline for the FDA’s review of Rivoceranib’s New Drug Application (NDA) is set for March 20. Industry experts speculate that the decision could come up to a month earlier, given that past approvals, such as GC Biopharma’s immunoglobulin drug ‘Aliglo’, were issued ahead of the PDUFA deadline.

The FDA is currently reviewing Rivoceranib in combination with the immunotherapy drug ‘Camrelizumab’ as a first-line treatment for liver cancer. Rivoceranib is an oral targeted cancer therapy developed by HLB’s U.S. subsidiary, Elevar Therapeutics. In 2007, HLB Elevar acquired the global rights (excluding China) for Rivoceranib from U.S.-based Advenchen Laboratories. The drug works by inhibiting VEGFR-2 (vascular endothelial growth factor receptor-2), blocking the oxygen and nutrient supply needed for cancer cell growth and essentially “starving” the tumor by preventing blood vessel formation.

In May 2023, HLB faced an FDA rejection, which the company attributed to issues with manufacturing facilities belonging to its Chinese partner Jiangsu Hengrui Pharmaceuticals, the developer of Camrelizumab.

The industry anticipates continued volatility in HLB’s stock price leading up to the FDA’s decision. A similar surge occurred in May last year when the company’s stock price reached 122,000 KRW ahead of the FDA review.

However, experts remain divided on HLB‘s approval prospects. Some analysts cite geopolitical tensions between the U.S. and China, noting that Rivoceranib’s clinical trials were conducted in collaboration with a Chinese pharmaceutical company, which could influence the FDA’s decision. In 2023, the FDA approved 55 new drugs, but only two were developed in China. Notably, while Camrelizumab has been approved in China for non-small cell lung cancer and liver cancer, it has not yet received FDA approval.

On the other hand, optimists argue that approval is likely due to the strong efficacy of Rivoceranib and Camrelizumab, as well as the fact that the previous FDA rejection was due to manufacturing issues rather than concerns about the drugs themselves.

When asked about the reason behind the stock price surge, an HLB representative stated, “Even internally, we are unsure about the cause,” offering no further comment.

Authorities Move Quickly to Address Concerns

According to MP Doctor (formerly “Market Point”), the stock price of Geneone Life Science closed at 2,245 KRW, up 9.78% from the previous trading day. Genexine was involved in COVID-19 vaccine development during the pandemic.

|

The newly discovered virus belongs to the Merbecovirus group, which includes the virus responsible for Middle East Respiratory Syndrome (MERS). While it shares similarities with the common cold virus (NL63), it exhibits a stronger ability to infect human cells compared to other coronaviruses. However, researchers explained that it does not easily penetrate human cells compared to the COVID-19 virus that spread globally in 2020. Notably, this virus was not detected in humans but was isolated in a laboratory setting.

The study was published on February 18 in the prestigious scientific journal Cell. It was conducted by renowned bat virus expert Dr. Shi Zhengli, also known as “Batwoman,” in collaboration with researchers from the Guangzhou Institute of Science, Wuhan University, and the Wuhan Institute of Virology. Despite concerns, the researchers clarified that the virus “does not easily invade human cells like COVID-19” and “was identified in a laboratory, not in humans.”

The KDCA also urged the public not to overinterpret the findings. During a briefing, the agency stated, “This study was conducted using cell cultures in a laboratory setting, and there is currently insufficient circumstantial evidence to suggest human infection. Therefore, it is important to avoid exaggeration.”

Kim Eun-jin, head of the KDCA’s Novel Pathogen Analysis Division, acknowledged that “while we cannot completely rule out the possibility of human infection, the study found that the virus’s ability to bind to human receptors is significantly weaker compared to MERS or COVID-19. Therefore, the likelihood of immediate human transmission is low.”

As a result, most vaccine and diagnostic kit stocks that had surged in early trading saw their gains diminish. Genexine‘s stock price initially rose by 24%, but some of those gains were later reversed. Other companies that saw gains included Cellid (+4.39%), SK Bioscience (+0.10%), Sugentech (+10.69%), and Medicox (+29.63%), which previously developed a COVID-19 treatment through its subsidiary.

Most of these stocks closed with reduced gains, except for Medicox, which hit the daily price limit. The company had previously announced plans to develop a COVID-19 treatment through its subsidiary, Mecox CureMed, but it remains unclear whether development is still ongoing. Investors are advised to exercise caution, as the company’s business report does not mention any ongoing COVID-19 treatment development. Instead, Medicox primarily operates in the manufacturing sector, producing large ship blocks.

Meanwhile, companies affected by this news appeared indifferent. A Genexine representative stated, “There is no specific company stance on today’s stock price increase. It seems to be influenced by reports of the new coronavirus in China, but we cannot predict what will happen tomorrow.” Similarly, a Sugentech representative stated, “The company has not made any announcements or released any positive news related to today’s stock price increase.”

Is the ‘Big Day’ Approaching?

On the same day, HLB’s stock price rose 7.58% to close at 88,000 KRW, driven by market expectations ahead of the FDA’s upcoming decision on the liver cancer treatment ’Rivoceranib‘.

|

The FDA is currently reviewing Rivoceranib in combination with the immunotherapy drug ‘Camrelizumab’ as a first-line treatment for liver cancer. Rivoceranib is an oral targeted cancer therapy developed by HLB’s U.S. subsidiary, Elevar Therapeutics. In 2007, HLB Elevar acquired the global rights (excluding China) for Rivoceranib from U.S.-based Advenchen Laboratories. The drug works by inhibiting VEGFR-2 (vascular endothelial growth factor receptor-2), blocking the oxygen and nutrient supply needed for cancer cell growth and essentially “starving” the tumor by preventing blood vessel formation.

In May 2023, HLB faced an FDA rejection, which the company attributed to issues with manufacturing facilities belonging to its Chinese partner Jiangsu Hengrui Pharmaceuticals, the developer of Camrelizumab.

The industry anticipates continued volatility in HLB’s stock price leading up to the FDA’s decision. A similar surge occurred in May last year when the company’s stock price reached 122,000 KRW ahead of the FDA review.

However, experts remain divided on HLB‘s approval prospects. Some analysts cite geopolitical tensions between the U.S. and China, noting that Rivoceranib’s clinical trials were conducted in collaboration with a Chinese pharmaceutical company, which could influence the FDA’s decision. In 2023, the FDA approved 55 new drugs, but only two were developed in China. Notably, while Camrelizumab has been approved in China for non-small cell lung cancer and liver cancer, it has not yet received FDA approval.

On the other hand, optimists argue that approval is likely due to the strong efficacy of Rivoceranib and Camrelizumab, as well as the fact that the previous FDA rejection was due to manufacturing issues rather than concerns about the drugs themselves.

When asked about the reason behind the stock price surge, an HLB representative stated, “Even internally, we are unsure about the cause,” offering no further comment.

석지헌 기자 cake@edaily.co.kr

![글로벌 생태계에 녹아들자[바이오, 해외에 답 있다]⑤](https://image.edaily.co.kr/images/vision/files/NP/S/2025/02/PS25022600610b.jpg)

![신종 바이러스 공포에 알리코제약 上…기술수출 기대감에 올릭스·CJ바사 ↑[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/02/PS25022600682b.jpg)