P Daehwa Pharmaceutical, Anygen Hit Upper Limit; HLB Group Stocks Struggle Amid Rumors[K-Bio Pulse]

등록 2025-03-11 오전 8:10:10

팜이데일리 프리미엄 기사를 무단 전재·유포하는 행위는 불법이며 형사 처벌 대상입니다.

이에 대해 팜이데일리는 무관용 원칙을 적용해 강력히 대응합니다.

이에 대해 팜이데일리는 무관용 원칙을 적용해 강력히 대응합니다.

이 기사는 2025년3월11일 8시10분에 팜이데일리 프리미엄 콘텐츠로 선공개 되었습니다.

구독하기

[Kim Sae-mi, Edaily Reporter] Daehwa Pharmaceutical stocks surged to its daily upper limit on Monday as it launched sales in China, while Anygen also hit ceiling on expectations that its acquisition by HLB Group would resolve its financial difficulties. In contrast, HLB Group stocks suffered steep declines in early trading amid rumors ahead of the U.S. Food and Drug Administration’s decision on its liver cancer drug, Rivoceranib. However, the group managed to recover some losses following a swift company announcement.

Daehwa Pharmaceutical Surges on China Cancer Drug Launch

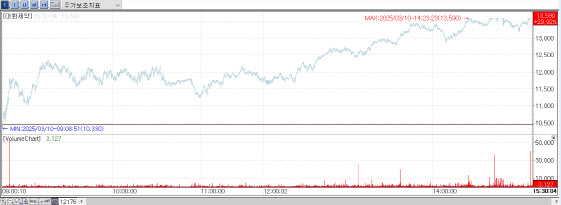

According to KG Zeroin’s MP Doctor(formerly MarketPoint), Daehwa Pharmaceutical stocks closed at 13,590 won on March 10, up 3,130 won (29.92%) from the previous day. This is the maximum range a stock can climb in a day in South Korea, where the stock market has price change limits of plus-minus 30 percent per day. Daehwa Pharmaceutical’s rally was largely driven by an exclusive pay-to-read article from PharmEdaily, Edaily’s premium pharmaceutical and biotech content service. The article was made publicly available on web portal services at 9:31 a.m. on the day.

The PharmEdaily article reported that Daehwa Pharmaceutical had officially begun sales of Liporaxel in China. Liporaxel is the world’s first oral paclitaxel formulation, which is a drinkable cancer treatment. Since mid-February, Liporaxel has been available in China through Daehwa’s local partner, Haihe Biopharma, in collaboration with local distributor 3S BIO.

Liporaxel is an oral reformulation of Taxol (paclitaxel), a blockbuster cancer treatment with a global market of approximately 5 trillion won ($3.75 billion). Originally developed and marketed by Bristol Myers Squibb, Taxol has been used for more than 30 years as an intravenous injection. Daehwa applied its proprietary DHLASED lipid-based self-emulsifying drug delivery platform to Liporaxel, improving upon the limitations of intravenous paclitaxel.

Daehwa Pharmaceutical aims to expand Liporaxel’s indications from gastric cancer to metastatic and recurrent breast cancer to increase market share in China’s oncology sector. Expectations are also high for a boost in earnings from these expansions.

Beyond oncology, Daehwa Pharmaceutical is targeting China’s filler market and transdermal drug delivery system sector, including dementia patches. The company is considering additional regulatory filings for its SF16 Fine and SF20 Medium hyaluronic acid filler products. It is also pursuing export deals for its rivastigmine dementia patch in China.

A Daehwa Pharmaceutical spokesperson said, “Other than today’s PharmEdaily article, there were no specific catalysts.”

Anygen Hits Upper Limit on HLB Group Acquisition, cGMP Approval Hopes

While Daehwa Pharmaceutical surged on China market prospects, Anygen hit its daily upper limit for two consecutive sessions on expectations of U.S. regulatory approval. The stock closed at 11,340 won, up 2,610 won (29.9%) from the previous day, marking a three-day rally. From March 5, when it traded at 5,840 won, the stock soared 94.2% to its latest closing price.

According to the company, the rally was fueled by expectations of current Good Manufacturing Practice (cGMP) approval and a 200 billion won ($150 million) announcement on March 6 for operational funding. An Anygen spokesperson said, “The expectation for cGMP approval and the March 10 disclosure about the capital increase likely contributed to the stock surge.”

Another notable driving factor was HLB Group’s acquisition of Anygen. The company had struggled for months with delayed and revised plan for capital increases since its 200 billion won private placement announcement on Dec. 20, 2023. Over six amendments, the private placement recipients changed three times, and the payment deadline was repeatedly postponed.

Initially, Widwin Investment Association No. 81 and 82 were designated as investors, but the payment deadline was extended from Dec. 30, 2023, to Jan. 24, then Feb. 7, before they withdrew. New investors, Bethel Private Equity and Moda Asset Management, were named, moving the payment deadline to March 6. Then, on March 6, the investors changed again to KD Holdings and Cheongdam Partners, with a final payment deadline of March 19.

On March 10, the final private placement investors were confirmed as HLB affiliates, including HLB Genex, HLB Life Sciences, HLB Biostep, HLB Panagene, and HLB Investment. Office furniture manufacturer KOAS also participated. The seven HLB affiliates will investe 150 billion won in the private placement and acquired 50 billion won in convertible bonds.

Additionally, financial investors will commit another 50 billion won in the private placement and acquired 350 billion won in convertible bonds.

With this 600 billion won investment from HLB Group, Anygen successfully resolved its financial difficulties. Notably, HLB Group is the only company in Korea with a GMP-certified peptide manufacturing plant, making Anygen a strategic acquisition to strengthen its peptide drug development capabilities.

Following the capital injection, Anygen plans to accelerate development of its new GLP-1 obesity treatment, which offers improved efficacy and pharmacokinetics compared with existing GLP-1 drugs. Analysts expect synergy with HLB Pharma, which is developing a long-acting injectable obesity treatment.

Im Chang-yoon, HLB Group’s vice chairman in charge of mergers and acquisitions, said, “Anygen was founded by Dr. Jae-il Kim, a leading global peptide expert, and has focused exclusively on peptide research for 25 years.”

HLB Group Stocks Plunge Amid FDA Approval Rumors

Meanwhile, HLB Group stocks tumbled amid rumors ahead of the FDA’s final decision on Rivoceranib, its liver cancer drug. Early in the trading session, HLB stocks plunged before recovering in the day, aided by a swift company announcement.

During the session, HLB’s stock dropped as much as 21.2% to 67,600 won before closing at 79,800 won, down 7%. HLB Pharma fell 29.9% to hit its lower limit at 20,500 won before recovering to 26,650 won, down 8.9%. HLB Therapeutics dropped as much as 28.9% to 7,090 won before closing at 8,800 won, down 11.4%.

Other HLB affiliates followed similar patterns.

HLB Innovation fell 21.1% to 2,080 won before recovering to down 5.5%. HLB Biostep dropped 19.6% to 1,910 won, closing at 2,195 won, down 5.4%. HLB Global plunged 18.4% to 3,400 won before ending at 2,960 won, down 4.1%.

As HLB Group stocks tumbled across the board, the company swiftly addressed the rumors via its official blog, stating: “The FDA has not yet made any decision. Once a decision is reached, we will announce it via YouTube. Please do not be misled by rumors.” The company added, “There are many malicious rumors regarding drug approval. As the decision date approaches, such rumors will likely intensify.”

Daehwa Pharmaceutical Surges on China Cancer Drug Launch

According to KG Zeroin’s MP Doctor(formerly MarketPoint), Daehwa Pharmaceutical stocks closed at 13,590 won on March 10, up 3,130 won (29.92%) from the previous day. This is the maximum range a stock can climb in a day in South Korea, where the stock market has price change limits of plus-minus 30 percent per day. Daehwa Pharmaceutical’s rally was largely driven by an exclusive pay-to-read article from PharmEdaily, Edaily’s premium pharmaceutical and biotech content service. The article was made publicly available on web portal services at 9:31 a.m. on the day.

|

Liporaxel is an oral reformulation of Taxol (paclitaxel), a blockbuster cancer treatment with a global market of approximately 5 trillion won ($3.75 billion). Originally developed and marketed by Bristol Myers Squibb, Taxol has been used for more than 30 years as an intravenous injection. Daehwa applied its proprietary DHLASED lipid-based self-emulsifying drug delivery platform to Liporaxel, improving upon the limitations of intravenous paclitaxel.

Daehwa Pharmaceutical aims to expand Liporaxel’s indications from gastric cancer to metastatic and recurrent breast cancer to increase market share in China’s oncology sector. Expectations are also high for a boost in earnings from these expansions.

Beyond oncology, Daehwa Pharmaceutical is targeting China’s filler market and transdermal drug delivery system sector, including dementia patches. The company is considering additional regulatory filings for its SF16 Fine and SF20 Medium hyaluronic acid filler products. It is also pursuing export deals for its rivastigmine dementia patch in China.

A Daehwa Pharmaceutical spokesperson said, “Other than today’s PharmEdaily article, there were no specific catalysts.”

Anygen Hits Upper Limit on HLB Group Acquisition, cGMP Approval Hopes

While Daehwa Pharmaceutical surged on China market prospects, Anygen hit its daily upper limit for two consecutive sessions on expectations of U.S. regulatory approval. The stock closed at 11,340 won, up 2,610 won (29.9%) from the previous day, marking a three-day rally. From March 5, when it traded at 5,840 won, the stock soared 94.2% to its latest closing price.

According to the company, the rally was fueled by expectations of current Good Manufacturing Practice (cGMP) approval and a 200 billion won ($150 million) announcement on March 6 for operational funding. An Anygen spokesperson said, “The expectation for cGMP approval and the March 10 disclosure about the capital increase likely contributed to the stock surge.”

Another notable driving factor was HLB Group’s acquisition of Anygen. The company had struggled for months with delayed and revised plan for capital increases since its 200 billion won private placement announcement on Dec. 20, 2023. Over six amendments, the private placement recipients changed three times, and the payment deadline was repeatedly postponed.

Initially, Widwin Investment Association No. 81 and 82 were designated as investors, but the payment deadline was extended from Dec. 30, 2023, to Jan. 24, then Feb. 7, before they withdrew. New investors, Bethel Private Equity and Moda Asset Management, were named, moving the payment deadline to March 6. Then, on March 6, the investors changed again to KD Holdings and Cheongdam Partners, with a final payment deadline of March 19.

On March 10, the final private placement investors were confirmed as HLB affiliates, including HLB Genex, HLB Life Sciences, HLB Biostep, HLB Panagene, and HLB Investment. Office furniture manufacturer KOAS also participated. The seven HLB affiliates will investe 150 billion won in the private placement and acquired 50 billion won in convertible bonds.

Additionally, financial investors will commit another 50 billion won in the private placement and acquired 350 billion won in convertible bonds.

With this 600 billion won investment from HLB Group, Anygen successfully resolved its financial difficulties. Notably, HLB Group is the only company in Korea with a GMP-certified peptide manufacturing plant, making Anygen a strategic acquisition to strengthen its peptide drug development capabilities.

Following the capital injection, Anygen plans to accelerate development of its new GLP-1 obesity treatment, which offers improved efficacy and pharmacokinetics compared with existing GLP-1 drugs. Analysts expect synergy with HLB Pharma, which is developing a long-acting injectable obesity treatment.

Im Chang-yoon, HLB Group’s vice chairman in charge of mergers and acquisitions, said, “Anygen was founded by Dr. Jae-il Kim, a leading global peptide expert, and has focused exclusively on peptide research for 25 years.”

HLB Group Stocks Plunge Amid FDA Approval Rumors

Meanwhile, HLB Group stocks tumbled amid rumors ahead of the FDA’s final decision on Rivoceranib, its liver cancer drug. Early in the trading session, HLB stocks plunged before recovering in the day, aided by a swift company announcement.

During the session, HLB’s stock dropped as much as 21.2% to 67,600 won before closing at 79,800 won, down 7%. HLB Pharma fell 29.9% to hit its lower limit at 20,500 won before recovering to 26,650 won, down 8.9%. HLB Therapeutics dropped as much as 28.9% to 7,090 won before closing at 8,800 won, down 11.4%.

Other HLB affiliates followed similar patterns.

HLB Innovation fell 21.1% to 2,080 won before recovering to down 5.5%. HLB Biostep dropped 19.6% to 1,910 won, closing at 2,195 won, down 5.4%. HLB Global plunged 18.4% to 3,400 won before ending at 2,960 won, down 4.1%.

As HLB Group stocks tumbled across the board, the company swiftly addressed the rumors via its official blog, stating: “The FDA has not yet made any decision. Once a decision is reached, we will announce it via YouTube. Please do not be misled by rumors.” The company added, “There are many malicious rumors regarding drug approval. As the decision date approaches, such rumors will likely intensify.”

!['2% 로열티'가 무너뜨린 신뢰…알테오젠發 바이오株 동반 하락[바이오맥짚기]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/01/PS26012201091b.jpg)