Wegovy Boosts BlueMtech; HASS Soars, BioSolution Falls [K-Bio Pulse]

created on 05/09/2025 7:56:18 AM

Unauthorized reproduction or distribution is illegal and subject to criminal penalties.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

Pharm Edaily enforces a zero-tolerance policy and will take strict action.

This article was released as Pharm Edaily Premium Content on 05/09/2025 7:56:18 AM

Subscribe

[Seok, Ji-hoen, edaily reporter] Shares of South Korean biopharmaceutical firms saw mixed results Thursday, with BlueMtech and HASS soaring on investor optimism, while BioSolution plunged despite a successful clinical trial announcement.

‘Thank You Wegovy’

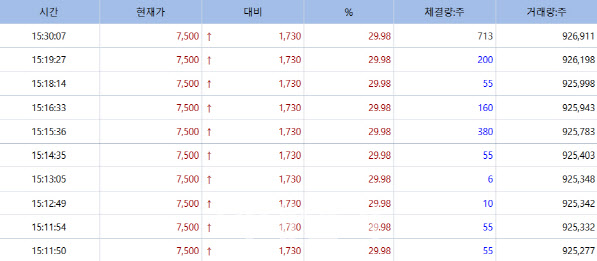

BlueMtech jumped 29.98% to close at 7,500 won, buoyed by explosive growth in sales of Wegovy, Novo Nordisk‘s obesity drug. According to MP DOCTOR (formerly MarketPoint), BlueMtech reported 60 billion won ($44 million) in Wegovy distribution revenue in April, a sixfold increase from the previous month.

BlueMtech operates Bluepharm Korea, an e-commerce platform for pharmaceuticals that distributes Wegovy in South Korea. The company cited enhanced services like same-day delivery in Seoul and membership benefits as drivers behind the revenue surge. The average purchase price also tripled, suggesting a sharp influx of high-volume buyers.

Within just 45 days of launching, more than 28,000 Wegovy prescriptions have been administered in the country. “We’re committed to maintaining a stable supply and enhancing our logistics services, especially ahead of expected summer demand,” said CEO Kim Hyun-soo.

In addition to the Wegovy boom, BlueMtech is betting on its flu vaccine distribution business and expanded cold-chain logistics capabilities. The company acquired a 30.9% stake in Gonggam Plus last year, securing over 100 refrigerated trucks and completing a new temperature-controlled warehouse in July 2023. It also signed a co-promotion deal with Sanofi Korea in August to distribute two flu vaccine products.

HASS Rallies on Elderly Care Policy Momentum

Shares of HASS, a dental prosthetic materials company, surged 16.98% to 10,060 won. The rally came after opposition Democratic Party presidential candidate Lee Jae-myung unveiled a set of senior welfare policies on Parents’ Day, including lowering the age for dental implant health insurance coverage and increasing the number of implants covered per patient.

Lee’s announcement ignited a rally in implant-related stocks such as Meta Biomed, Alphagnox, Dentium and Dentis.

Unlike conventional implant makers, HASS is South Korea’s only manufacturer of lithium disilicate, a high-strength glass-ceramic used in dental restorations. The company holds the No. 3 global market share in this niche segment. Lithium disilicate offers strength and translucency similar to natural teeth, making it ideal for crowns, veneers, and other restorations. Only a few companies worldwide have successfully commercialized this advanced material.

BioSolution Slumps Despite Clinical Win

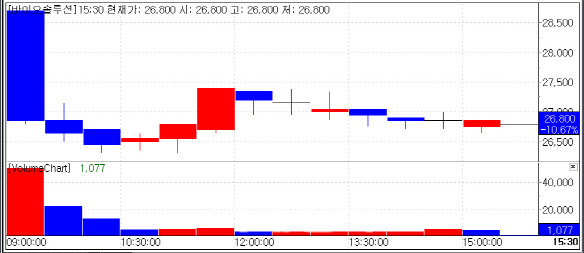

In contrast, BioSolution dropped 10.67% to close at 26,800 won, retreating after a 11.32% gain the previous day. The company had announced promising results from its U.S. Phase 2 trial for CartiLife, a next-generation autologous chondrocyte implantation (ACI) therapy for knee osteoarthritis.

CartiLife showed statistically significant improvements in cartilage regeneration and symptom relief, especially among patients with underlying osteoarthritis. At week 48, the mean cartilage defect fill score was 14.2 out of 20, far above the 9-point average seen in conventional microfracture techniques in South Korea. The therapy also significantly improved KOOS scores (Knee injury and Osteoarthritis Outcome Score), including subcategories such as pain, function, and quality of life.

The trial, approved by the U.S. FDA in November 2019, enrolled 20 patients across five U.S. sites and completed dosing in January 2024.

Despite the clinical success, investor profit-taking appears to have weighed on the stock. “There are no operational concerns,” a BioSolution spokesperson said. “Given the well-flagged trial timeline, it seems some investors moved to lock in gains.”

The company said it plans to pursue multiple regulatory pathways for early commercialization of CartiLife in the U.S.

|

BlueMtech jumped 29.98% to close at 7,500 won, buoyed by explosive growth in sales of Wegovy, Novo Nordisk‘s obesity drug. According to MP DOCTOR (formerly MarketPoint), BlueMtech reported 60 billion won ($44 million) in Wegovy distribution revenue in April, a sixfold increase from the previous month.

BlueMtech operates Bluepharm Korea, an e-commerce platform for pharmaceuticals that distributes Wegovy in South Korea. The company cited enhanced services like same-day delivery in Seoul and membership benefits as drivers behind the revenue surge. The average purchase price also tripled, suggesting a sharp influx of high-volume buyers.

Within just 45 days of launching, more than 28,000 Wegovy prescriptions have been administered in the country. “We’re committed to maintaining a stable supply and enhancing our logistics services, especially ahead of expected summer demand,” said CEO Kim Hyun-soo.

In addition to the Wegovy boom, BlueMtech is betting on its flu vaccine distribution business and expanded cold-chain logistics capabilities. The company acquired a 30.9% stake in Gonggam Plus last year, securing over 100 refrigerated trucks and completing a new temperature-controlled warehouse in July 2023. It also signed a co-promotion deal with Sanofi Korea in August to distribute two flu vaccine products.

HASS Rallies on Elderly Care Policy Momentum

Shares of HASS, a dental prosthetic materials company, surged 16.98% to 10,060 won. The rally came after opposition Democratic Party presidential candidate Lee Jae-myung unveiled a set of senior welfare policies on Parents’ Day, including lowering the age for dental implant health insurance coverage and increasing the number of implants covered per patient.

|

Unlike conventional implant makers, HASS is South Korea’s only manufacturer of lithium disilicate, a high-strength glass-ceramic used in dental restorations. The company holds the No. 3 global market share in this niche segment. Lithium disilicate offers strength and translucency similar to natural teeth, making it ideal for crowns, veneers, and other restorations. Only a few companies worldwide have successfully commercialized this advanced material.

BioSolution Slumps Despite Clinical Win

In contrast, BioSolution dropped 10.67% to close at 26,800 won, retreating after a 11.32% gain the previous day. The company had announced promising results from its U.S. Phase 2 trial for CartiLife, a next-generation autologous chondrocyte implantation (ACI) therapy for knee osteoarthritis.

|

The trial, approved by the U.S. FDA in November 2019, enrolled 20 patients across five U.S. sites and completed dosing in January 2024.

Despite the clinical success, investor profit-taking appears to have weighed on the stock. “There are no operational concerns,” a BioSolution spokesperson said. “Given the well-flagged trial timeline, it seems some investors moved to lock in gains.”

The company said it plans to pursue multiple regulatory pathways for early commercialization of CartiLife in the U.S.

석지헌 cake@

![[韓 AI신약개발 진단]① K-신약 인공지능, 美와 격차 벌어지는 까닭](https://image.edaily.co.kr/images/vision/files/NP/S/2025/05/PS25050900885b.jpg)